Articles

How We Tamed the Budget Monster

- By AFP Staff

- Published: 6/5/2023

An AFP member explains how a siloed work culture and time-consuming annual budget process created a rift between finance and the business at his company, and how he stepped in to create a culture of forecasting that promotes collaboration.

An AFP member explains how a siloed work culture and time-consuming annual budget process created a rift between finance and the business at his company, and how he stepped in to create a culture of forecasting that promotes collaboration.

The AFP FP&A Case Study series is designed to help you build up key FP&A capabilities and skills by sharing examples of how leading practitioners have tackled challenges in their work and the lessons learned.

Presented at an AFP Advisory Council meeting, this case study contains elements that are anonymized to maintain privacy and encourage open discussion.

Insight: Creating a culture of continuous forecasting can bring FP&A closer to the business and reduce the burden of the budgeting process.

| Company Size: | Medium |

| Industry: | Clothing & Apparel |

| Geography: | Global |

| FP&A Maturity Model: | Finance & Business Acumen |

Finance and business acumen: FP&A translates corporate and business strategy into a financial plan and supports the enactment of that plan through resource allocation. Processes generate input and insight through financial analysis, supported by enabling technology.

BACKGROUND: GENERAL INFORMATION ABOUT THE COMPANY

The subject of this case study is a privately held global company, headquartered in Europe, that has over 20,000 employees worldwide. It sells clothing and apparel via multiple channels (wholesale, retail and online). For all retail companies, accurately forecasting demand and sales is crucial to managing their inventory. However, this company saw an increasing divergence between its inventory and sales, contributing to decreasing margins. The COVID-19 pandemic disruptions added another layer of challenge.

This case study was presented by the regional finance director of the company who joined the company with a mandate to turn around the business after a period of faltering performance and COVID disruption. At the time, a lot of work was being performed in silos, resulting in a poor relationship between markets and regional headquarters and global headquarters.

CHALLENGE: THE WORK OR DIFFICULTY FP&A HAD TO ADDRESS

The regional finance director conducted a survey to understand his new company. First, he asked the finance managers in the various markets, “What are your biggest pain points?” Then, he asked the general managers of the business, “What do you think about your finance business partner?”

The results showed a clear disconnect between what finance should have been doing with the business and what was actually occurring, with the budget process being a primary pain point for both groups.

| Finance: What are your biggest pain points? | Business: What do you think about your finance business partner? |

|---|---|

| Annual budgets are a nightmare. “It's like a monster that appears during budget season; we have nightmares just thinking about it.” | Budgets are a finance thing. “Finance gets lost into this thing in the third quarter of the year and makes us suffer through it too.” |

| No time: “We are swamped with monthly closing/business reviews, variance analysis, refresh reports, and everyone asking ‘why?’” | Finance is untouchable half of the month. “Finance says to us, don’t talk to me until I’m done closing.” |

| Little respect from the business: “They think of us as ’budget police’ who only say what they can or cannot spend.” | Agreed that finance is the “budget police.” |

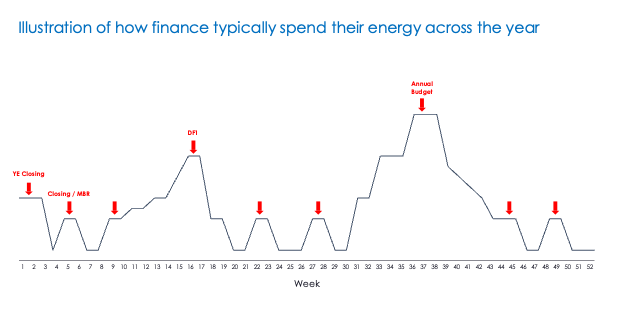

Next, the regional finance director conducted another survey, this time to get an idea of how finance spends its time during a typical year. The results are shown in the chart below; the elevated effort from weeks 31 to 43 represents the energy preparing for and reviewing the budget after its submission.

The second-largest expenditure of energy was around the mid-year review, called dynamic forecast (DF1). The outcome of this effort produced quite different numbers as compared to the budget, which raised the question, why spend so much time on the budget only to have it become obsolete two months into the year? In addition, finance exerted high levels of work on monthly closing and business reviews during the first two weeks of every month (at the expense of engaging with business partners because “we are too busy”), including justification of variance to budget which delivered minimal value to running the business.

APPROACH: HOW FP&A ADDRESSED THE CHALLENGE

The regional finance director’s solution to the challenge was to de-emphasize the annual budget process as a unique event and create a culture of continuous forecasting instead. This would help to separate out the many roles of the budget — incentive target, forecast and capital allocation tool — that turned it into a “massive monster.”

To solve this issue, the regional finance director defined three different planning tools:

| Tool | Usage |

|---|---|

| 1) Outlook |

|

| 2) Budget |

|

| 3) Forecast |

|

The schematic below shows how the different tools align with each other. The rolling forecast (which has a meandering path) may be above or below budget over the course of the year and is the tool that finance manages on a day-to-day basis.

Next, the regional finance director established the following principles for how finance enacted the planning process:

- Budgets cannot be the only time we talk about the future.

- Forecast frequently, all year round, as this is the pulse of the business.

- Actuals should not come as a surprise; we should directionally know the results before the monthly close.

- Forecasting is never just a finance function; it must be a business partnership.

He implemented a simplified, single planning calendar that integrates both budgeting and forecasting:

- Every week, finance discusses the rolling forecast with the business to better understand the drivers. The conversation is forward-thinking and action-oriented. Because finance and the business are talking weekly, the results at the end of the month are no longer a surprise. Eventually, the monthly business reviews were redundant and dropped — freeing up more time for the business and finance.

- In the second month of every quarter, there is a business review to understand the quarter-to-date, anticipate where the quarter will end, and look ahead to the next quarter by discussing key commercial drivers and activities (a rolling forecast). The focus is on the business drivers and not so much the forecast numbers — hence this is not just another “finance review.”

- The annual budget is built on the quarterly business reviews (QBR) and 3-year rolling outlook (which is discussed at the 2nd QBR. The weekly and quarterly rhythms mean the annual process is more routine and leverages existing knowledge.

The regional finance director established rules of how finance should engage with the business to ensure that meetings stayed focused on the decisions that needed to be made, that finance maintained a forward-looking growth mindset, and that partners would be less reluctant or transparent in working with finance.

- Change the language: Rather than asking “why” to explain small deviations, ask more action-oriented questions, such as, “What does this mean? How does this change our business?”

- Ask fewer questions with more depth on the key drivers for the business: volume sales, efficiencies or margins. Target questions around things the business can influence.

- Alleviate “forecasting paralysis” (trying to forecast everything at all levels of detail).

- Avoid finance jargon in business meetings because it is not the language of the business partners, e.g., do not explain variances with over/under accrual and reversal of provisions (most business folks get lost halfway through the explanation).

- Don’t fixate on the numbers but appreciate the story behind them instead, i.e., the ROAD (Risks, Opportunities, Assumptions, Dependencies).

OUTCOME: WHAT CAME OF FP&A’S EFFORTS AND WHAT WAS LEARNED

The annual budgeting process still remains, but the process changes allow teams to seamlessly flow into budgeting as there is already alignment and rhythm. The budgeting process is no longer a “nightmare” or a “finance-only thing.”

Through the changes, finance has also gained a seat at the business table. At the quarterly business review, finance gets 25 of the 90 minutes allocated to the meeting. This is less than before, and this is considered to be a win for everyone! The focus during these meetings is the next quarter, and the discussion centers on various KPIs, metrics and trends. Because the meeting brings all of the functions together, particularly from the regional headquarters, different functions are able to lend their support to the business, and they are able to get support from finance at the same time.

In addition, finance has been able to make more of a positive impact on the business by improving demand planning and reducing inventory, thereby helping to reverse the declining profitability trend.

DISCUSSION: Q&A AMONG COUNCIL MEMBERS

What happens when your business partners are uncomfortable giving up the budget? I tried once and almost had a mutiny on my hands!

I think being consistent in our approach to planning has been important; it shows that we are serious in making this change and working closely with them. We must be intentional not to ask certain questions. For example, if I see a variance, I ask fewer “why” questions, such as “Why is it minus 10% versus minus 8%?” Instead, I ask, “What is the story behind this number? What is the plan moving forward?” I pivot quickly to what is going to happen in the future. The numbers are not as important to me as the story behind them and what we are going to do about it.

We are a publicly listed company and our shareholders expect a certain level of dividend, a certain level of return on capital. The annual budget is one of the key ways we hold ourselves accountable to the delivery of a certain set of metrics. How did you give your owners comfort that you're doing the right things by them?

Most of what I implemented here I had also done previously at a listed company where we delivered quarterly guidance and forecasts for Wall Street and the markets. For us now, budgets are still important; but the budget is only one cog in the planning wheel. My message to the team is not to get hung up on the numbers. We know where our scenarios are; we know where our recent opportunities are. We talk about it, then we try to move on it.

Our owners are investors in the business, so we’re always asked, “Are we giving them better returns than if they were to invest the same amount of capital elsewhere?” So that's a question we often ask ourselves and also often ask the business.

How do you set targets? If you base it on the budget, it becomes unrealistic. If you base it on forecasts, people will think we are moving the goalposts.

I'm championing that incentives should be based on a more holistic set of KPIs and be more actions-based instead of simply results; worse still a set of consolidated results that an individual has very little influence on. I do this to encourage some risk-taking, innovation and entrepreneurial spirit. If we always make it about a certain number we need to hit, you are essentially hampering people from taking certain actions. We should reward actions as well, not just results.

Many of these conversations are largely focused on top line and growth, but how do you address challenges around product costing, sourcing, the things that are a pain on the shop floor?

The conversations cut across all dimensions because the principle or key question we ask is not, “How do we beat a certain number or how we can spend less?” It's about how can we get more for what we spend. So it is relevant in all discussions and we can stop being the budget police and asking, “How do we spend less?” Instead, let’s ask, “How do we spend better?”

Build up key FP&A capabilities and skills with AFP’s FP&A Maturity Model, a roadmap to help you and your team become leading practitioners.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.