Articles

Organizations’ Cash and Short-Term Allocation to Bank Deposits at Lowest Level in 4 Years

- By Joanne Oh

- Published: 6/29/2023

Forty-seven percent of organizations’ cash and short-term allocation are maintained in bank deposits, according to the 2023 AFP Liquidity Survey, underwritten by Invesco. This figure is down 8 percentage points from 2022 and is the lowest recorded in four years.

In response to the bank failures that occurred in March 2023, organizations began moving their cash and short-term investments from banks into Government/Treasury money market funds (up 4 percentage points), Treasury bills (up 2 percentage points) and Agencies (up 2 percentage points).

Thirty-eight percent of treasury professionals report that their organizations plan to continue increasing their cash allocations to Government/Treasury money market funds into the next year, while only 8% indicate that their companies plan to decrease allocations to these funds. However, 27% plan to increase allocations in bank deposits, while 25% are looking to decrease their deposits in banks.

Dive deeper into the findings from the 2023 AFP Liquidity Survey, underwritten by Invesco, by attending the companion webinar, Liquidity in an Uncertain Landscape. Join us on Jul 20, 2023, at 3 PM ET, to hear about the importance of banking relationships, management of investment objectives, consideration of ESG parameters and more.

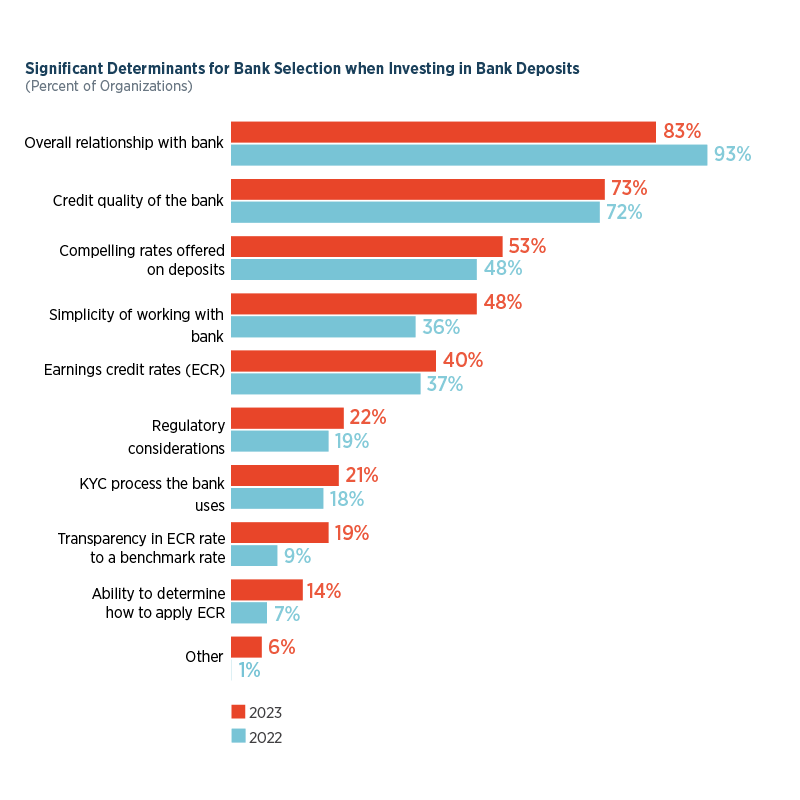

An organization’s overall relationship with its bank remains the primary determinant in choosing where to maintain deposits (cited by 83% of respondents). However, this figure is down 10 percentage points from 2022 and suggests that treasury professionals are choosing to be more cautious in their approach to relationships with banking partners in response to recent bank failures.

Other Key Survey Findings

Environmental, social and governance (ESG) parameters are influencing almost half of organizations’ investment policy revisions, with 27% adding ESG parameters/mandates and 21% adding ESG Money Funds in their investment policy.

Despite a tumultuous environment, the three primary investment objectives reported by treasury professionals remain consistent with those of 2022: safety (cited by 63%), liquidity (33%) and yield (4%).

When choosing a U.S. domestic Prime/Floating NAV Fund, yield (cited by 50% of respondents) continues to be the primary selection criterion. However, this figure is down from the 68% reported in 2022. In turn, the share of respondents who select a fund based on the ease of transaction process rose 17 percentage points (38%).

About the Survey

The 2023 AFP Liquidity Survey was conducted in March 2023 and received responses from 222 treasury professionals from organizations of varying sizes representing a broad range of industries.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.