Articles

The Financial Rewards of Sustainable Strategies

- By Elyse Douglas

- Published: 6/15/2023

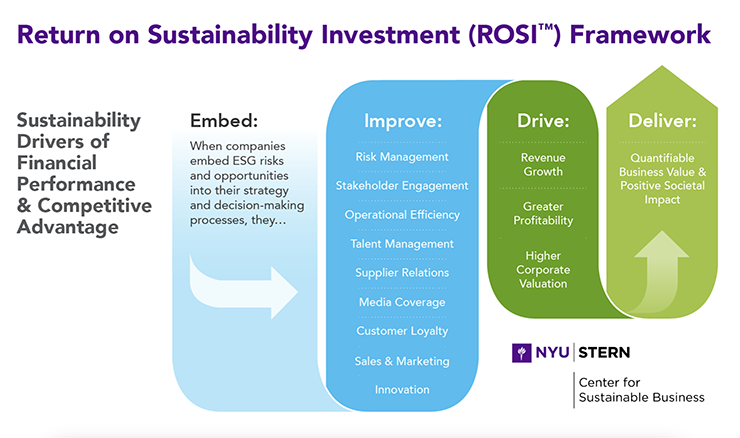

At the NYU Stern Center for Sustainable Business (CSB), we believe companies that embed sustainability into their corporate strategy and decision-making processes will deliver positive social impact and higher business value as seen through revenue growth, increased profitability and higher valuations.

In addition to maintaining compliance, sustainable strategies reap tangible benefits, including the ability to:

- Attract and retain high-performing employees.

- Allocate capital to investments that maximize returns and/or minimize risks.

- Set appropriate strategic targets and key metrics to measure performance.

- Build stronger, more resilient supply chains.

- Achieve competitive advantage through innovation.

However, achieving these outcomes requires companies to define, document and demonstrate value across four dimensions: economic, social, brand and compliance. But how can companies quantify the benefits of sustainable strategies? Through the Return on Sustainability Investment (ROSI) framework:

The ROSI framework helps companies get full credit for what their sustainability initiatives have already accomplished while simultaneously encouraging innovation to uncover additional opportunities. It does this by focusing attention on specific areas (“mediating factors” in the Improve column of the graphic above), then credibly proving and quantifying the financial and societal benefits.

For example, a sustainable strategy might originate in one part of the organization, but the benefits might flow through another part of the organization, preventing full recognition. Some benefits might have been identified as operational efficiencies but were not ascribed to sustainability activities. A focus on sustainability can also create real innovation and opportunities.

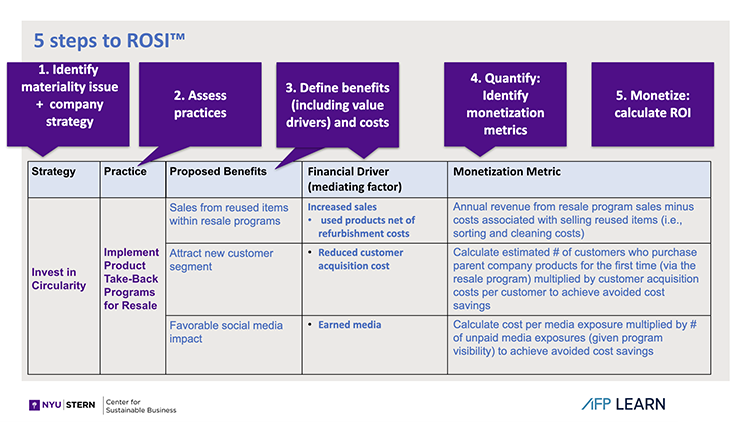

Implementing the ROSI framework is a five-step process, outlined below.

| Step | Description |

|---|---|

| 1. Identify Material ESG Issues and Strategies |

Choose a challenge appropriate to your business (a “material ESG issue”) and how your business is addressing associated risks and/or opportunities.

|

| 2. Assess Practices | Determine the business practices that have been or could be implemented to address sustainability strategies. |

| 3. Define Benefits and Cost | A cost-benefit analysis. Costs are generally explicit; the quantifiable benefits could arise from changed practices in the mediating factors: risk management, stakeholder engagement, operational efficiency, talent management, supplier relations, media coverage, customer loyalty, sales & marketing, and innovation. |

| 4. Quantify Benefits | Estimate the magnitude of those benefits and when they could be realized; define the metrics and source supporting data. |

| 5. Monetize | Gather the data, translate the benefits into economic value, stress test and forecast ROI. |

Below is an example of the ROSI framework in use. In this example, an apparel company was dealing with waste as a material ESG factor. They wanted a strategy around circularity and developed a program that would take back used clothing in exchange for a voucher to buy their own product. In doing this, they were able to achieve a $1.8 million benefit.

It is important to think about different categories of benefits in order to know where and how to measure them.

Driving Economic Value

To give an example of how the ROSI framework has helped identify economic benefits, one project that Stern CSB worked on in the automotive industry identified 18 different strategies where companies could address their material issues. These issues included product quality and safety, fuel efficiency and emissions and material sourcing, efficiency and recycling.

One of the strategies in use — to recover, reuse, recycle and reuse as much waste as possible — led to five benefits which yielded $235 million of profit impact in the first year:

- Material cost savings due to lower spend on recycled materials (even after cost of recycling) relative to virgin materials.

- New revenue stream from sales of other materials to recyclers.

- Input cost savings from water management systems (less water, recycling water).

- Energy savings due to lower use for recycled materials (as compared to virgin materials).

- Reduction in waste disposal costs.

Another strategy was to create an end of useful life program. In some jurisdictions, automotive manufacturers are responsible for the disposal of the vehicle when it reaches its ultimate end of life. One client set up arrangements with different parties to dismantle the vehicles, separate the parts and send them to recyclers. While this began as a compliance program, this company found that they were able to recover and reuse 2.5% back into new vehicles. In addition, another 10% could be sold to recyclers and opened a new revenue stream. The total benefit associated was $100 million annually. Quantifying the benefits justified these investments and supported the search for similar innovations.

Driving Societal Value

To give another example, Cargill has articulated that the ROSI framework gave them a disciplined and comprehensive approach to talking about their sustainable strategies both inside and outside of the company.

Cargill was promoting soil health practices with their soybean farmers, such as “no-till,” which avoids plowing at seeding time (a practice that releases soil carbon into the environment at a rate of 0.32 metric tons of carbon per acre). Cargill was also promoting a second practice of planting alternative cover crops in between seasons to build nutrients in the soil, which sequesters carbon at a rate of 0.35 metric tons per acre (but does incur extra costs for farmers limiting its use). Globally, 38% of the global land mass is agricultural-related, but at the time of our analysis, only 37% of US farmers had adopted these practices (and even fewer outside the US); this was a huge opportunity.

We worked with four farmers in the Cargill supply chain that adopted these practices and found that they actually had input cost savings as well as yield benefits ranging between $28 and $66 per acre. We were able to identify benefits of approximately $12 per acre based on better farming: more stable yields which led to price risk avoidance, increased resilience during variable weather conditions, and lower crop insurance cost. We also estimated the societal benefit of keeping carbon, nitrogen and phosphorus in the ground and monetized, based on carbon trading markets, an estimated return of $45 per acre.

By looking at the benefits to the farmers, we were able to understand what those implications were to Cargill. At the time, it was worthwhile for Cargill to pay the farmers to adopt these practices because of the identified benefits, such as a stable soybean supply that led to operating efficiencies, enhanced brand image, improved farmer loyalty, improved employee engagement, and potential future carbon market opportunities estimated at approximately $2 million per year.

Similar to the automotive example, what began as risk mitigation to address supplier resilience to climate change gave Cargill the ability to also look at growth opportunities. Quantifying the value for themselves provided support to pay others for these beneficial outcomes. After our research with them, Cargill announced a program called Regen Connect to create their own carbon market and pay farmers for those soil outcomes. It has now been rolled out to 24 states.

Driving Brand Value

Our research at the CSB examined how products marketed as sustainable performed relative to conventional products, based on actual purchase data of approximately 40% of all consumer products that were sold over a five-year period.

We found that the share of sustainability-marketed products increased every year, from 13.7% to 17.3%, even with a 27% price premium to conventional products. The CAGR for sustainably marketed goods grew at close to twice the rate of conventional goods, 9.4% versus 4.9%. Clearly, any consumer goods company looking for growth must also look at sustainability today.

We did some work with the brewer Anheuser-Busch to value their practices around nutrient management with their barley growers to apply the right type of fertilizer at the right rates, at the right time, and in the right places. This led to benefits in reduced nitrogen usage, carbon emissions, energy usage in malting operations and other process inputs. It also aligned with the company’s 2040 net-zero carbon emission goals (which are both environmental and economic, as they assume a future carbon pricing tax).

The major benefit, however, was the potential to enhance the brand value. Being able to offer a more sustainable product could capture higher sales through higher volume growth and pricing. And offering a sustainably brand would protect its share with sustainably focused customers. Anheuser-Busch could anticipate net benefits over a 10-year period of $25 million from this new product line and an additional $6 million of avoided lost sales to a competitor. (Anheuser-Busch also had experience in launching a product with a sustainable message, Michelob Ultra Gold, which was an organic product line, and that provided a roadmap and some historical comparable data.) If two-thirds of the value of sustainable strategies is realized in brand value (public relations, marketing, employee retention, partner relations), then quantifying the economic and societal value can be levered up to estimate the total value.

Driving Compliance Value

While the sustainability reporting regulations are evolving across multiple jurisdictions, the implications are clear: New regulations are arriving and will require greater oversight and evidence via as quantification.

A Summary of the Regulatory Landscape

| Current | Future | |

|---|---|---|

| U.S. | Only requires disclosure of material risk factors in the 10K. |

SEC Proposal:

|

| Europe | Corporate Sustainability Reporting Directive (CSRD) requires companies to publish regular standardized reports on companies’ environmental and social impact activities. |

Proposed CSRD expansion:

|

How to Get Started with the ROSI Framework

As the framework implies, you need to know what you are measuring and develop good data resources around it.

- Take inventory of your company’s current disclosures: Start collecting and reporting on Scope 1, 2 and 3 emissions and ensure there are no “material gaps or misstatements in […] disclosure of climate risks under current rules.”

- Enhance ESG reporting with disclosure and governance controls. Most corporate sustainability reports are manually produced, and companies need to elevate this to the level of financial reporting with ERP systems capturing ESG data. This may resemble the Sarbanes Oxley controls efforts of two decades ago.

- Look at strategies from a risk and opportunity perspective. The Task Force for Climate-Related Financial Disclosures has published guidance on setting strategy, designing key performance indicators, and promoting scenario analysis in terms of how climate change might impact the business.

Additional Resources

NYU Stern CSB offers in-depth resources on ROSI, including a step-by-step overview of the framework, research publications, industry case studies and Excel tools for download.

About the Author

Elyse Douglas has over 30 years of experience in public accounting, banking and corporate finance. She was the CFO of Hertz, and for the past six years, has been the Senior Research Scholar at NYU’s Stern Center for Sustainable Business (Stern CSB), helping corporations understand how to quantitatively express the benefits of sustainable business.

This article is based on her AFP webinar, The Financial Rewards of Sustainable Strategies.

More Articles on Sustainable Finance

Integrating ESG into Enterprise Risk Management for Regulatory Compliance

Integrating ESG into an organization’s enterprise risk management (ERM) program is emerging as a key theme, as organizations seek to avoid the pitfalls of more siloed approaches to ESG. Not only is such integration considered a best practice, but regulators are also increasingly requiring companies to disclose how they integrate climate risks and opportunities into their governance and corporate strategy.

Does Green Capital Lead to Green Decisions?

The surge of “green investing” in capital markets reflects increased demand among professional and household investors to put their money into climate-friendly products and low-emission production. A common objective of green investors is to stimulate the future investments and growth of “green companies.” For green investing to succeed in this endeavor, two conditions need to hold.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.