Articles

The Journey from FP&A to CFO

- By AFP Staff

- Published: 6/5/2023

Many of the skills that make FP&A a strategic partner to the business lead well into the skills that make the CFO a trusted advisor. It’s no surprise then that FP&A has become a career stop for many on the path to CFO.

At an AFP FP&A roundtable, one CFO shared his story of how he went from working almost exclusively in FP&A to becoming a CFO. The following is an excerpt from his presentation, “FP&A to CFO Journey.”

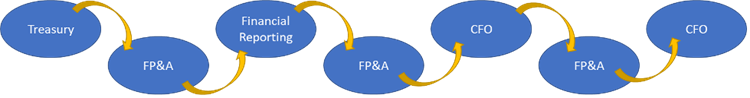

Career Path

Before I first became a CFO, I worked almost exclusively in FP&A across various multi-billion-dollar international public companies. In interviews, no one ever really cared that I might have been new to the industry; they wanted to know that I had the core skills, such as budgeting, forecasting, analysis and board experience.

I have an unusual history of the companies I work for being bought and sold or having their headquarters relocated to places I did not want to be, so I have changed jobs a few more times than I would have liked!

Getting That First CFO Role

I have read studies about the most recent role for current CFOs. It is either a lateral move from a similar-size company where you're already the CFO or an internal promotion where you're a clear candidate.

I would also say it is helpful to have a variety of experiences in your career. I spent three years doing SEC reporting, filing 10-Qs and 10-Ks. I have a CPA from work early in my career and an FPAC because that propelled my FP&A work. Had I held one type of role for 20 years, I do not think I would have gotten a diverse enough range of experiences to become a CFO.

In my twenties, I was ambitious, so if I couldn't get the next title in two or three years, I would go somewhere else. Sometimes you can get that broad exposure within your company, and sometimes you need to move outside the company.

There are both generalities and specialties at the CFO level and it is important to understand that companies will value specific skills at different stages of their own development. Once, I worked for a real estate company that wanted a mergers and acquisition person in that role because they were doing so many deals. Some companies are looking for CPAs because they are building their accounting and controls foundation, or perhaps because that is how they see the finance. I look for companies that value the FP&A role; one time, I joined a global manufacturing company where the CFO had spent seven years in FP&A.

Learnings from Working at a Small Company

My ultimate career goal is to be a CFO of a large company, and the best way to become a CFO is to have already been a CFO once before. This is what led me to my first CFO experience with a small, family-owned company. Here is what I learned from that experience:

Pros

- On the executive team. The best part is being a trusted advisor who gives input on all key company management issues. People look to the CFO for quantitative input and impact on the finances, as well as general business strategy. It is a lot of fun.

- Broad role. I had the opportunity to lead IT as well as accounting and finance and learned a lot from those interactions.

- Decision-making. I was in a position to make decisions myself instead of providing advice to others who were making the decisions.

- The door to other opportunities. The first CFO job on a resume opens the door to recruiters calling for other CFO roles.

Cons

- Lack of sophistication. There's a bigger view of how to solve the world's problems and that just didn't exist at a small company.

- Complicated personal dynamics of a family-owned business.

- A do-it-yourself experience. A small company means a small team, and they did not have all the skills needed to handle all the finance functions. While there were some things I could delegate, it was not a reasonable expectation to have every skill resident in the team. I had to step in and set up the ERP system and reporting system, put a P&L together and do the analysis. Through this, I realized that I wanted a larger company where I could do more strategic analysis!

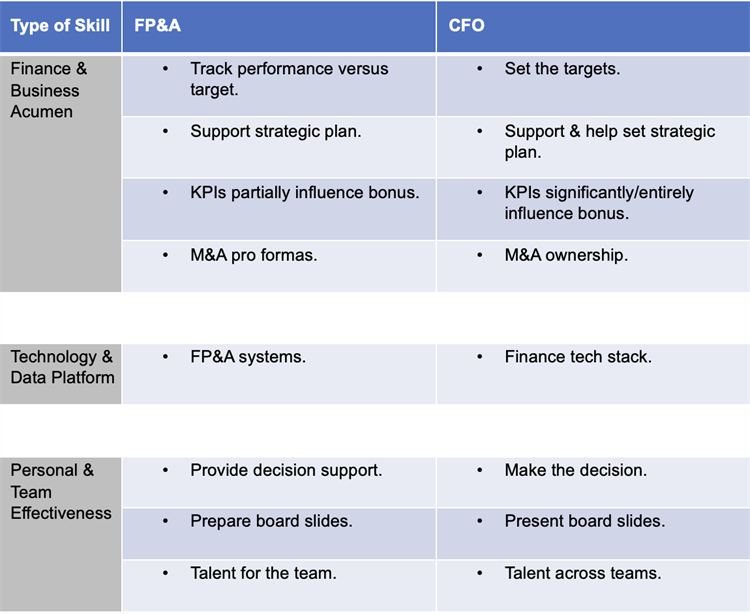

Transferal of FP&A Skills

One of my classmates from business school recruited me to become the CFO of a private equity-owned company, with a goal to roll up smaller companies and then flip the newly consolidated firm. It is very fast-paced and very demanding work, as we are trying to do many different things all at the same time.

My experience in FP&A helped to prepare me for a lot of the work I do as a CFO. The difference is that now, in my CFO role, I really own the work and the outcomes. In FP&A, we would support the plan for the company strategy. Now I help set the plan. How should we grow? Should we expand into consumables? Should we go into an adjacent category? Should we grow geographically? I work very closely with the company CEO on those things, and a large part of my compensation is based on attaining those outcomes.

Here is an example of how FP&A can lead into CFO skills and roles:

New Skills to Acquire

As CFO, I have treasury reporting to me now and we have all the cash management responsibilities. I have to manage banking relationships, which are critical in a private equity-owned company. We have a lot of debt, and I work with our banking partner constantly to watch our covenants.

I also am responsible for the risk and control environment. We're doing our first audit controls and risk evaluation. A big part of my job is using judgment to make sure that what we decide is low priority really is low priority.

I mentioned earlier being part of the leadership team. I like being the CEO's right-hand person. I think that I move fast, but he moves at light speed, and it is very hard to keep up with him because he wants to grow the company as quickly as possible. I want to get things right the first time and have a little more order and discipline. That's a challenge for me to manage. And I obviously have to build a good relationship with the PE sponsor as well.

Saying No to CFO Roles

After the presentation, the roundtable group discussed some of their own experiences and perspectives.

“What kind of CFO are you looking for?” is the first thing one two-time CFO says when a recruiter calls. “They know exactly what they need. Sometimes they are PE-driven and looking for someone to run a portfolio company. Sometimes they are owner- or founder-driven. Sometimes it is a growth story, where the previous CFO was more like a controller and now, for the first time, they want a CFO to be more forward-looking and less accounting driven. I think that's where our expertise comes in. I always ask, ‘Do you have a strong controller in place, or can I hire one?’ If they say no, I let them know I can’t play that role and they might need somebody else.”

One SVP of a billion-dollar firm said, “It is helpful to know the type of company, the size of the company, and the type of skills you want to exercise in your career. For me, I'm very clear. I do not want to go to a very small company where I have to set everything up. I do not enjoy it. But there's a certain level between a small company and a huge company, and that is the niche where I want to be.”

One CFO said, “Being in the C-suite is a higher stress level, especially when things don't go well. There's high risk, high reward in terms of compensation, but being CFO is not for everyone. I have a friend in a similar role and he is really struggling with his mental health right now.”

One Director of FP&A/BI/Analytics said, “I don’t want to be CFO. It's more of a personality issue and knowing yourself. The CFO’s primary role is to establish guardrails around process, reporting and performance. My specialty is breaking through barriers and building and transforming. If I do end up at a large corporation someday, I'll be heading transformation or something like that.”

Build your career plan with the AFP Guide to Career Pathing. Learn how to identify the right time to make a move in your career, how to network and mentor effectively, and the skills you’ll need to prepare for the future.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.