Additional unbiased content that helps you navigate innovative treasury and finance trends, topics and technologies.

AFP Payments Guide to Unlocking the Cash Conversion Cycle

Underwritten by MUFG

All organizations know the importance of managing cash and working capital; without them, organizations simply cannot exist. Yet, when targeting growth, too many organizations focus on trying to increase sales or to reduce supplier costs, while ignoring the potential benefits of efficient working capital management.

A renewed focus on internal processes can unlock working capital “trapped” in the cash conversion cycle, which is then available to be recycled back into the business. Freeing this cash has a direct impact on the business’ bottom line. It allows the business to grow, without making another sale, simply because working capital that was previously being used to fund an inefficient process can now be invested to help the company achieve its strategic objectives.

This guide starts by outlining the core working capital relationship: the cash conversion cycle (CCC). It then explores why managing the CCC is important and identifies ways treasury can influence it via the three key levers: accounts payable, accounts receivable and inventory management. It also contains a downloadable spreadsheet with to examine each component of the cycle using sample financial data.

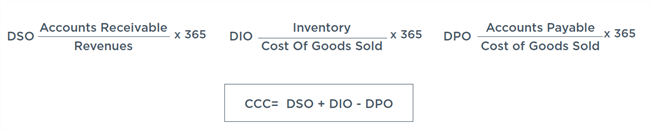

THE CASH CONVERSION CYCLE FORMULA

The CCC represents the time required to convert cash outflows associated with production into cash inflows through the collection of A/R. In short, the CCC is calculated as the average age of inventory (days inventory) plus the average age of A/R (days receivables) minus the average age of A/P (days payables).

The CCC highlights the critical nature of monitoring the:

• Amount of time it takes to sell inventory

• Length of time between when a sale is made and when cash is collected

• Actual disbursement period

Download the guide and sample spreadsheet here

Published February 8, 2022