Articles

4 Insights for Effective Communication in Finance

- By AFP Staff

- Published: 10/7/2024

Beyond balance sheets and market trends lies a powerful tool that can make or break financial endeavors: effective communication.

While data drives decisions, it's effective communication that propels understanding and action. It goes beyond the mere presentation of facts, encompassing storytelling, trust and cultural awareness, engaging the right people, impactful visuals and targeted messaging.

In September, AFP called in some experts to help finance professionals become better communicators in the AFP FP&A series, Getting Communication Right for Finance. Attendees were taken through the key elements of effective communication in action, leaving with a better understanding of their role, and new tools they could implement right away. Below are four key insights from the series.

Insight #1: Structure your presentations with intention.

When developing any communication (whether it’s a presentation, high-stakes email or one-pager), Janine Kurnoff, Co-founder and Chief Innovation Officer of The Presentation Company (TPC) and author of “Everyday Business Storytelling,” advises that you craft your message first.

“We have been telling stories for thousands of years; it's part of our DNA,” said Kurnoff. “And what I love about storytelling is that it creates trust, community and connection. But here's the truth: At work, we don't know how to apply storytelling. No one ever teaches us this, and we don't have the confidence or the skills.”

As a result, we create what Kurnoff called “Frankendecks” — presentations cobbling together ideas and data that lack a clear, cohesive narrative and visual strategy. In order to break this habit, she suggested structuring our presentations with intention, following four signposts: setting, characters, conflict and resolution.

- Setting: Builds context and helps get everyone on the same page by emphasizing what’s happening in their world (and gives them a reason to care). “Think of your audience nodding their heads, saying, ‘Okay, I’m with you,’” said Kurnoff.

- Characters: Help serve a critical function in stories by presenting who or what matters to your audience. “They remind us that what we're doing impacts people right now,” she said. “They could be named or unnamed, like consumers, customers or us.”

- Conflict: Gives your audience further reasons to care because it reveals the challenges they’re facing. “You need a little bit of healthy tension to give your audience a reason to care, to create momentum to push forward,” said Kurnoff. The conflict could be anything from a supply chain issue to pressure on margins or loss of key customers.

- This is the moment to introduce your big idea (the one thing you want your audience to remember) that leads to...

- This is the moment to introduce your big idea (the one thing you want your audience to remember) that leads to...

- Resolution: This is the point at which “you dig into a recommendation, or your plan, or an implementation timeline,” said Kurnoff. It may be weightier than other parts of your presentation, but you have the audience’s understanding and attention.

Insight #2: Effective communication in finance is crucial for building trust.

How you communicate is linked with the ability to be an effective partner. This was the premise of the session “Partnership Strategy: Don’t Get Lost in Translation,” presented by John Thompson, Partner and Corporate Finance Leader with Oliver Wyman.

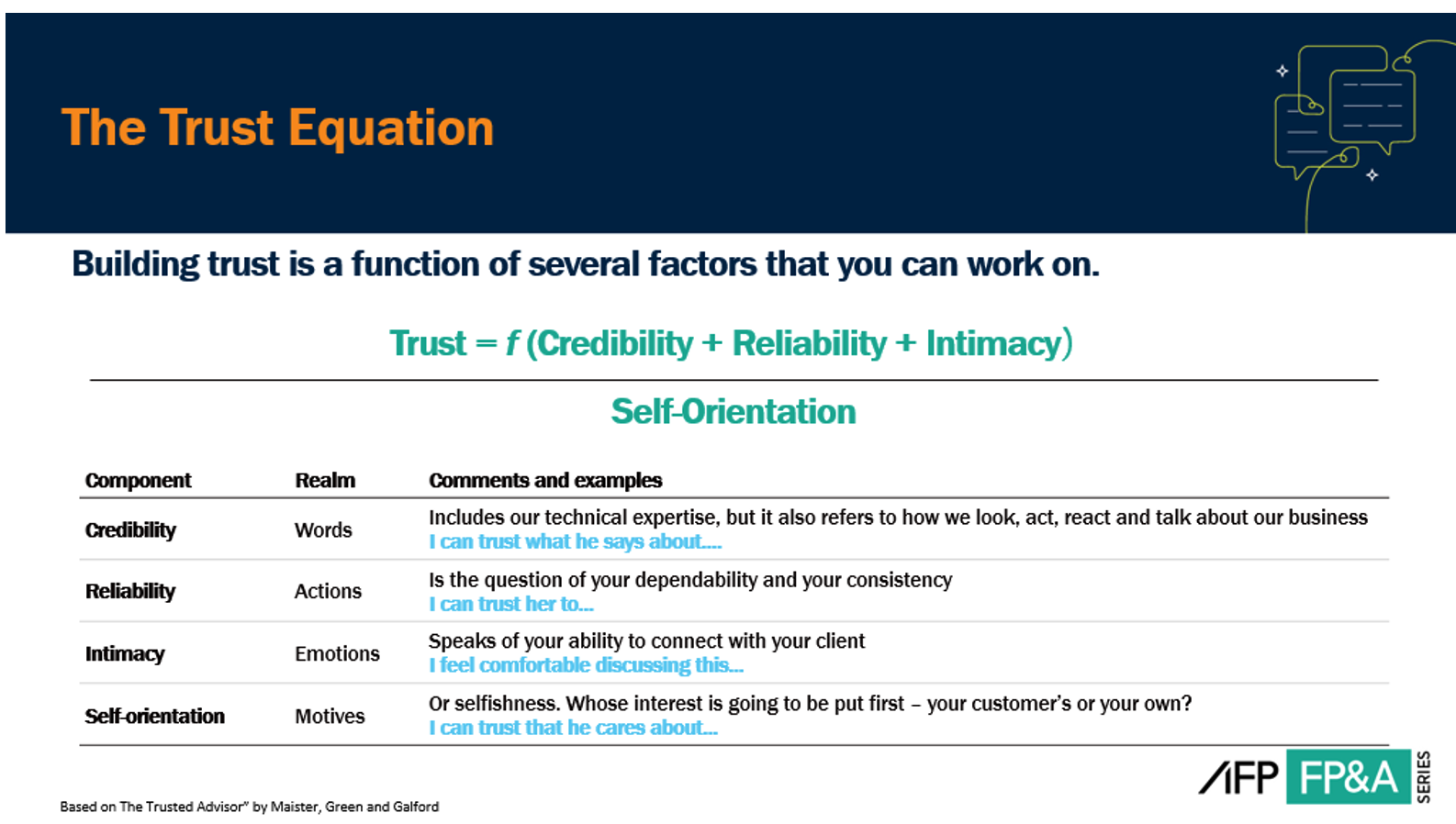

“Effective communication in finance is crucial for building trust, which can either diminish or enhance the value of relationships,” said Thompson. In this context, trust means “the belief or understanding that something is as it’s represented or has credibility.”

Equally important to the equation is culture, which Thompson defines as “a set of values and norms that exist within the company. The importance of culture lies in how people are likely to operate and ingest the information you give them or make decisions based on it. Culture can sometimes be a good predictor of behaviors or mindsets.

And it works both ways. Trust is enhanced if you operate within the norms of the culture; becoming an effective communicator builds more trust and stronger partnerships, which opens the path for more communication.

Below is an example of “The Trust Equation,” which illustrates how trust is a function of credibility, reliability, intimacy and self-orientation.

Insight #3: Your visuals should guide your audience to what they need to focus on.

Soufyan Hamid, Founder of The Finance Circle, addressed the importance of visuals in the session “Visual Strategy: Present Your Data with Impact."

“The people who read your report will not have the same time to digest what you did during your analysis,” said Hamid. It is your job to guide them to what they need to focus on — and visuals are an impactful way to do this.

“You have to do the work to make your story clear and concise,” he said. “In your presentation, you won't have time to go through all the details of your work; you need to highlight the most important parts for them.”

The slides in your presentation should contain a strong headline, a powerful visual and a clear explanatory paragraph. “The title should be a headline, a phrase or a full sentence. People should know what you are going to talk about and the angle you are going to use,” said Hamid. “It should focus on the business events rather than the financial information.”

Hamid also stressed the importance of using simple words to convey the main points or insights. “Unless you are trying to win the Nobel prize for literature, your goal is to write as little text as possible on your slide,” he said.

Here are a few additional tips from Hamid:

- Powerful visuals imprint the message you’re trying to convey in the audience’s brain.

- Practice visual proximity. “Visual proximity means people don’t want to make the effort to look first at the data bars, then the figure, then the legend, and back to the data bars,” said Hamid.

- Put an annotation next to the data point you want people to focus on.

- Try to remove as much ink (text) in the data visualization before pasting it into your slide.

Insight #4: Make the effort to understand your audience and ensure the right people are invited.

John Sanchez, Managing Director of The FP&A Group, talked about the importance of engaging with your audience in his session “Engagement Strategy: Elevate Your Engagement and Communication.” Below is Sanchez’s advice on what to do before, during and after a meeting.

Before the meeting:

- Understand your audience. Take the time to think about who your audience is (e.g., senior leadership, functional department), what they know (e.g., finance or nonfinance people), and what they want. Establishing these elements will help you lay out an agenda for the meeting that meets everyone’s needs, including your own.

- Invite the right people. “Be selective with invitations and schedule people thoughtfully,” said Sanchez. When thinking about who needs to be in the room, consider this simplified paradigm of the makers and the managers.

- Makers are productive when they are engaged in tasks. “When I was a financial analyst, my most productive time was on the keyboard in Excel, not in meetings,” he said. In other words, the best use of their time is probably not going to be attending a meeting. Get their input beforehand, and then follow up with them after. Invite them if it is a growth opportunity or if their expertise adds to the conversation.

- Managers are productive when they’re in meetings. “There are managers who spend the majority of their productive time meeting with people; they're checking on the progress of different projects, mentoring and supervising,” he said.

- Makers are productive when they are engaged in tasks. “When I was a financial analyst, my most productive time was on the keyboard in Excel, not in meetings,” he said. In other words, the best use of their time is probably not going to be attending a meeting. Get their input beforehand, and then follow up with them after. Invite them if it is a growth opportunity or if their expertise adds to the conversation.

If you need to meet with both, consider creating maker days and manager days. And regardless of who you’re meeting with, be sure to create clear and effective agendas. “Follow the rule: No agenda, no attendance!” he said.

During the meeting:- Use context effectively. Provide your audience with relevant and key background information, and frame your agenda within the larger business context.

- Engage with appropriate language and tone. This, too, goes back to who you are meeting with. Use the terminology familiar to your audience and adapt your tone to your audience — e.g., more casual with your team, more formal with senior leadership.

After the meeting:

- Follow up. Provide attendees (and other stakeholders) with meeting minutes, decisions made and action items with agreed-upon deadlines.

- Share feedback. How effective was the meeting? Seek input from attendees as a way to consistently improve your communication skills.

Learn More About Effective Communication in Finance

- 5 Tips for Creating an Effective Financial Presentation

- 5 Ways to Improve Your Verbal Communication Skills in Finance

- 5 Common Types of Financial Charts for Data Storytelling

- Improve Your Meetings by Asking These 2 Questions

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.