Articles

APAC FP&A Advisory Council on Control vs. Value-focused Finance

- By Brooke Ballenger

- Published: 10/4/2021

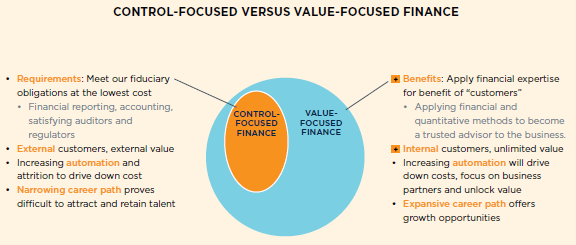

The finance organization has been in flux for decades, striving to expand its role from financial control to a business advisor who adds value through quantitative and strategic acumen.

Finance leaders must ask themselves: what type of finance organization do we want to be? Moving from a control-focused to a value-focused finance function starts with a vision of what is possible.

Last month, the APAC FP&A Advisory Council held a discussion around this topic and explained how their organizations function through both a control- and value-focused lens. In order preserve the privacy and free flow of the discussion, names and companies were not used.

How does finance add value?

One member kicked off the conversation by explaining how whether an organization is a control-driven or value-driven function depends on its financial ability. “My company just turned profitable last year, and there is a huge inflation coming in next year,” he said. “My boss was trying to be more value-driven last year, but since we heard inflation is set to rise due to the coronavirus pandemic, the atmosphere changed. His focus is controlling all the expenses during these next two years.” While most organizations would like to be value-driven, that capacity depends on the company’s financial outlook.

Another member had a different perspective. “You cannot cut costs as a way to achieve profitability,” he said. “The best way for finance to contribute is to be a strong business partner, identifying ways to grow the top line instead of just cost-cutting and controlling expenses.” However, he added that you do not want your expenses to be out of line with the top-line growth rate. “The cost-cutting side is important, but the more significant part is how finance can contribute to the overall growth of the business.”

“In my organization, the initial approach to finance was very cost and accounting-based,” a different member added. “As we evolved, we realized that we needed a different skill set, and therefore created an FP&A function. Our organization consists of both a finance controllership, which includes accounting and cost control, and an FP&A function.” The member added that whether you are more control-focused or value-focused may depend on the internal maturity or external environment. “For example, the finance function in some markets focuses on cost and risk control because that is what the environment is about,” she said. “The East Asia function focuses on FP&A because it is more future-looking and growth oriented. You need to adapt to your setting.”

Go in-depth on this topic: Attend the webinar, Becoming a Value-Focused Finance Organization, or download the AFP Guide to Becoming a Value-focused Finance Organization, sponsored by Workday.

For another member, value is about transparency and visibility to make information available for the decision-makers. “When the coronavirus pandemic hit last year, all of our costs were going up, including our cleaning, PPE and supply chain costs,” he said. “Our working capital completely changed because we are a government entity, and we were asked to provide payment holidays to some debtors and to defer supplier payments.” The changes had an impact on their balance sheet. “Our value then was having a cashflow forecast with very dynamic changes to our inputs and real-time results-sharing” to understand the limits of their accounts payable and accounts receivable impacts. It also set a template for extend this type of near-real-time reporting to other processes.

Perhaps framing the discussion as “control vs. value” is limiting because it does not recognize that controlling itself has value. A member looked beyond financial controlling to include control over spending, guidelines and project metrics. “It is a continuous process, where a good controller must constantly try to tackle new problems,” he said. “When we hire a new person, the controller needs to make sure that person understands all the processes in the company. When we open a new business line, the controller needs to make sure that it is coherent with the rest of the business in terms of the way we are accounting for things.” He concludes that FP&A is more value-focused in terms of having a forecast value, such as providing a forward-looking view, knowing exactly where the profitability and revenue is coming from, and knowing exactly where we are investing.

What holds finance back from achieving this value imperative?

In rapidly developing markets, CFOs spend years focused on building the accounting control foundation in their organization. While that may be been the original definition of value, that area become settled, but they may be unable to transition their mindset from accounting to the value-focused areas.

Risk aversion is inherent to so many people in finance, and there is a fear of being exposed for what they do not know. “As we move away from the controlling side to more forward-looking, we must step away from the things that we can control, and with it the need to be 100% guaranteed and defensible, into more things that are unknowable,” he said. “It takes a little bit of being comfortable with not knowing the answers.”

Contributing to risk aversion is the change to the new tools and materials of how finance creates value. “Since the majority of us come from finance, I have noticed an inherent fear about whether or not we have the skill set to understand the data from a business perspective,” one member said. “Do we have the technologies? Do we have a grasp on the technologies? Are we willing to let go of hugging that data sense and simply trust the information?”

However, the solution is never in the technology. “The challenge is that we do not have people to implement the technology and all the adequate tools in the market,” he said. “You must have internal champions so that the implementation of tools can be business-led and business-owned.”

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.