Articles

Cost Accounting to FP&A: How to Transition & Grow

- By Ben Wann

- Published: 8/11/2022

After spending most of my career in traditional cost accounting roles, I recently changed jobs from manufacturing plant controller to head of FP&A. Making this type of change within the office of the CFO can hold many benefits for those with a strong accounting foundation.

Reflecting on my own experiences, I shifted to FP&A to broaden my skill set and spend more time on analysis, which I had developed a talent for after spending a decade supporting manufacturing controllership. I wanted to produce measurable, visible work, and I was interested in the possibilities of using intelligent software to help organizations take their decision support to the next level.

For those who have spent much of their career handling all types of month-end and close cycles, FP&A can seem like a seamless fit. You get to move up the value chain and spend much more time analyzing information provided by the accounting function to derive insights for decision-makers.

However, because the skills, technologies and abilities required for accounting and FP&A are undergoing an evolution, it’s important to properly gear up to make the transition as smooth as possible.

Plan ahead and research the required skills

FP&A isn’t just accounting with fewer journal entries; it’s a field with distinct areas of knowledge, so you should consider the professional qualifications and critical skills required in the role. Studying for and attaining certifications, such as the FPAC, will provide you with a solid foundation in the technical areas and help you demonstrate commitment to the new role.

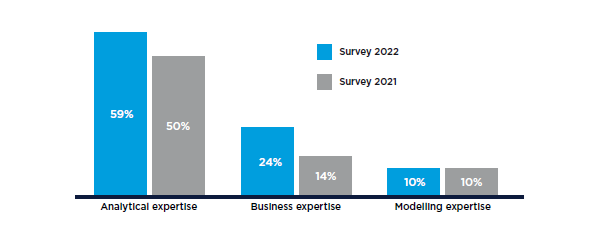

According to the FP&A Trends Survey 2022, analytical skills continue to be the most sought-after FP&A skill with 59% of respondents marking it as number one in 2022 (compared to 50% in 2021), and 24% choosing business skills (compared to 14% in 2021). You can benchmark yourself, identify skill gaps and create a plan to address those gaps.

Image 1: FP&A Trends Survey 2022

You can also search LinkedIn or Finance&AccountingCareers.com for the job titles of roles you would like to have in the next few years. Identify trends in required skills, experience and education to increase your odds of landing a similar role in the future.

During the career research phase, try to understand the more nuanced FP&A career paths across company size, industry, region, etc. Not all FP&A roles are the same or offer the same opportunities, so taking time to find the best fit between where you are now and where you would like to go is a smart move.

Begin performing data analysis as an accountant

While investigating the FP&A skill set, you will notice most of the roles today are involved with data. Whether it be process management, business intelligence or AI, data is a significant component of ensuring that the outputs used for decision-making are based on robust input data and controls.

Accountants looking to gain experience in data analysis can use free tools like Microsoft Power Query & Power Pivot to learn the basics of data ETL (extract, transform, load), modeling and dashboarding. Fortunately, accountants have access to much of an organization’s data, so it shouldn’t be too challenging to define a problem or thesis and then use these tools to investigate.

Ambitious accountants can look for opportunities to volunteer and take the lead in joining research projects — or creating their own — where they can explore and implement these tools for the accounting and finance teams. This will also introduce them to people in the business and their challenges.

Get involved in the business and operations

FP&A today reflects a partnership between those on the floor supervising production and other business activities. FP&A must have a strong understanding of all business activities to understand how each impacts the financials.

During the middle of the month, after close and reporting, is an excellent time for accountants to find projects to interact with others outside of accounting, understand the organization better and form key relationships. It’s also a safe time to ask lots of questions that may seem obvious to others but aren’t so clear outright.

One way to do this is to ask if you can attend meetings between FP&A and operations to understand the relationship between the two and to observe how to distill dollars and drivers to financial performance. Another is to “shadow” people in their roles.

Even if you stay in accounting, strengthening your business partnering skills is wise. By understanding the activities that increase costs and generate profits, you will improve your career no matter where you wind up. At the same time, you can share the finance view with the business and improve their capabilities.

Network with FP&A colleagues

To understand the different roles and make connections in your desired area, reach out to friends or others in your network. By speaking with multiple people from various organizations and experiences, you will get a broad understanding of the expectations and steps for an FP&A career. Network early and often. You may form relationships with those who could soon be looking to hire for a role where you would be a great fit.

While you shouldn’t frame these discussions as outright job seeking, there is certainly no harm in sharing your career aspirations and asking for guidance from those willing to share.

Articulate the value that you bring

The skills that an accountant brings to an FP&A team are powerful. Accountants will always ensure tie-outs are in place to maintain analysis trust. They can add clear language to variances that might otherwise be labeled as “missed accrual” or “out of period adjustment.” Accountants know how to dig deep to figure out what is really driving numbers and share them with the group. Even better, accountants are quick to recognize where data quality can be improved and can work with accountants to strengthen processes and control to create higher-quality data for all.

If you can emphasize how these skills create the perfect runway into FP&A, then connections will be more likely to remember you or share your name with others as new positions come up.

Ready for a career change? The 2022 FP&A Guide: The Transition from Accounting to FP&A lays out the steps you need to take to make your transition to FP&A successful. Get started today.

Benjamin Wann, CMA, CSCA, MBA, PMP, CPA, is purpose-driven and passionate about creating and sharing valuable, refreshing, and practical content to achieve Strategy-Execution and increase profitability by supporting those in Management Accounting within Manufacturing organizations.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.