Articles

Cost Optimization: Building Sustainable Advantage

- By AFP Staff

- Published: 9/18/2024

While eliminating, rationalizing and renegotiating contracts can yield quick wins, optimizing your cost base can deliver larger, more sustainable wins over the long term. This comprehensive approach requires a deep analysis of resource utilization and is designed to unfold over a two to three-year period, ensuring sustainable improvements that align with the organization's broader goals.

The AFP FP&A Case Study series is designed to help you build up key FP&A capabilities and skills by sharing examples of how leading practitioners have tackled challenges in their work and the lessons learned.

Presented at an APAC Advisory Council meeting, this case study contains elements that are anonymized to maintain privacy and encourage open discussion.

Insight: An empowered FP&A team that builds relationships with the business, looks at data in a new context and creates a disciplined structure can change the business mindset to own cost optimization activities.

| Company Size | Medium |

| Industry: | Electric power generation |

| Geography: | Asia-Pacific |

| FP&A Maturity Model: | Finance and financial processes |

Finance and Financial Processes: Apply finance acumen and financial processes to allocate capital to its most productive use and support decisions; Structured decision and financial analysis.

Background: General Information About the Company

The company featured in this case study is a utility that is responsible for the transmission and distribution network for electricity; they are undergoing a period of considerable expansion, with a workforce that has grown to 3,600 in the past year.

The presenter is the head of FP&A, which provides them with a unique perspective to witness the company’s growth and subsequent changes to its operating expenditure profiles.

The company plays a key role in the state government’s decarbonization goals. Connecting renewable energy sources — wind farms, solar farms and batteries — to the grid requires the utility to massively expand its network, which means a substantial capital investment. In fact, this will be the largest investment program in the company’s history, with a 25% increase in network investment expected year over year.

Challenge: The Work or Difficulty FP&A Had to Address

As a monopoly, the organization is regulated to ensure an efficient service at a fair price. The regulations include mechanisms such as performance targets and how much money can be earned in a five-year period to emulate a competitive market.

As an example, the current five-year period has a further 2% efficiency factor applied to the operating expenditure which is effectively a “saving” the regulator passes to the customers. This limits the ability to pass through increased costs of operations. During a growth period such as now, this puts additional pressure on options to set aside operating surplus to fund investments to expand.

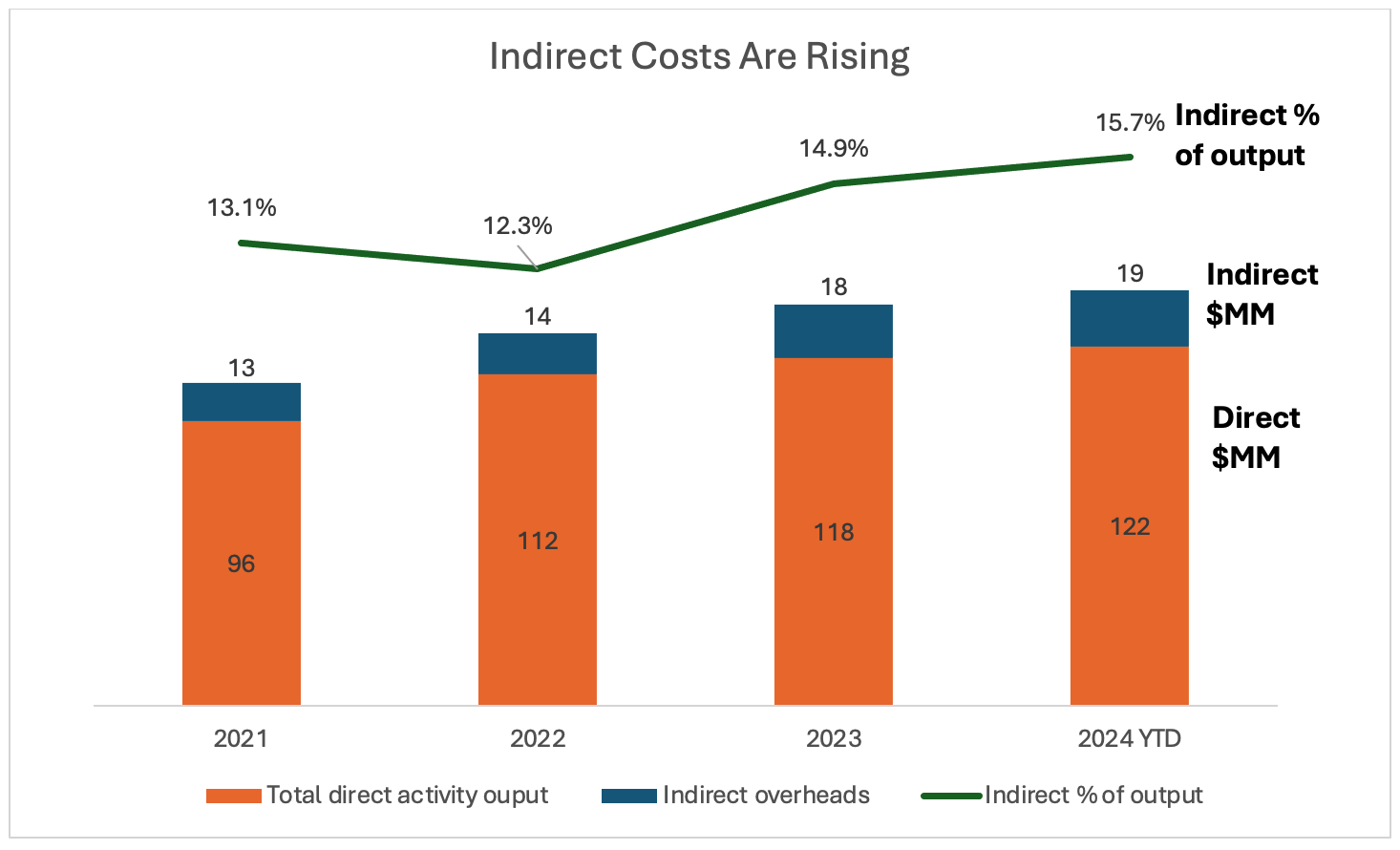

Operationally, overhead costs are increasing and are a larger proportion of total operational expenditure (see charts below). Is the company allocating resources correctly? In their efforts to right-size their team in order to build out the network, are they right-sizing in the right place?

The company is looking to reduce its expense base in the unregulated parts of the business or does not have the potential to earn a return in the future, thereby reducing the need to increase debt and free up capital to fund its reinvestment. However, a company cannot cut its way to growth! The head of FP&A is taking a cost optimization approach to focus on productivity and efficiency to gain a better understanding of the expenses and ensure resources are allocated to their best use.

Approach: How FP&A Addressed the Challenge

Rather than slashing expenses, the company adopted a structured optimization process with the goal of improving operations over the next 2-3 years with a focus on better resource utilization to make lasting improvements. Delving into the effectiveness of the company’s processes and systems “can get a little bit uncomfortable because you're really challenging the way people do things, and that's not always easy,” said the Head of FP&A.

To address the expected resistance, the team felt it was important to provide clear reporting and monitoring to document success and demonstrate momentum for the overall effort.

FP&A made sure to avoid stymying their growth in each step. “What we don't want to do is inadvertently stop anything that's going to hamper what we need to do to build out the network and meet the state’s decarbonization goals,” she said. All project streams required balancing operational risks against financial impact. “We have a ranking tool that allows us to look at the size of the opportunity versus the risk of doing it. We prioritize the safety and reliability of the network, and also ask, does it change the business significantly? Will it disrupt delivery or impact the crews? Can you demonstrate a financial benefit?”

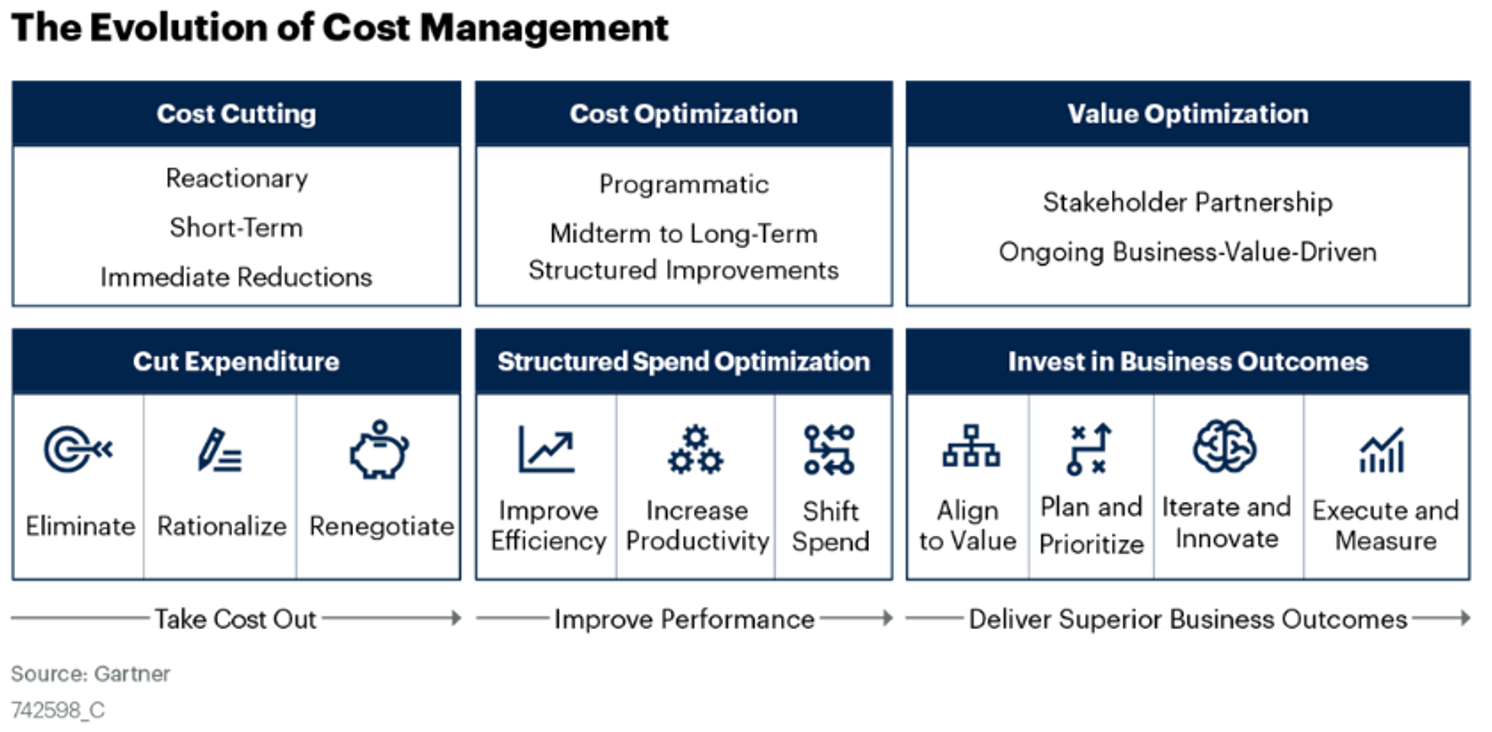

FP&A began by defining a company-wide mindset and leveraged Gartner’s Evolution of Cost Management framework (below). The basic layer is cost cutting, a reactionary, short-term approach to take cost out of the business. Cost optimization is more sophisticated, making structured improvements that improve performance. Conceptually, the third level is value optimization, delivering more value to stakeholders based on business operations.

BPR invoked six guiding principles:

- Focus on utilization and the productivity of resources.

- Ensure effectiveness of processes and systems.

- Provide reporting and monitoring.

- Balance risk and operational impacts.

- Assume a 2–3-year iterative process.

- Embed mindset change and cost discipline.

The company started by launching small-scale pilot projects to demonstrate to the executive team that they had the capability and skills internally to do it. With management’s green light, they identified additional opportunities and assessed each one according to the “size of the prize,” i.e., the potential benefits if time, effort and resources were invested.

Organizationally, they formed a steering committee that included two executives who would guide the process, help make decisions, and “have the last word if we needed to do things people were uncomfortable with.” A dedicated project manager was hired to oversee and coordinate the various projects.

A five-step process has emerged to evaluate the opportunities:

- The business identifies opportunities and raises them to the Program Manager, who “directs traffic” to ensure they are unique from other projects already in flight.

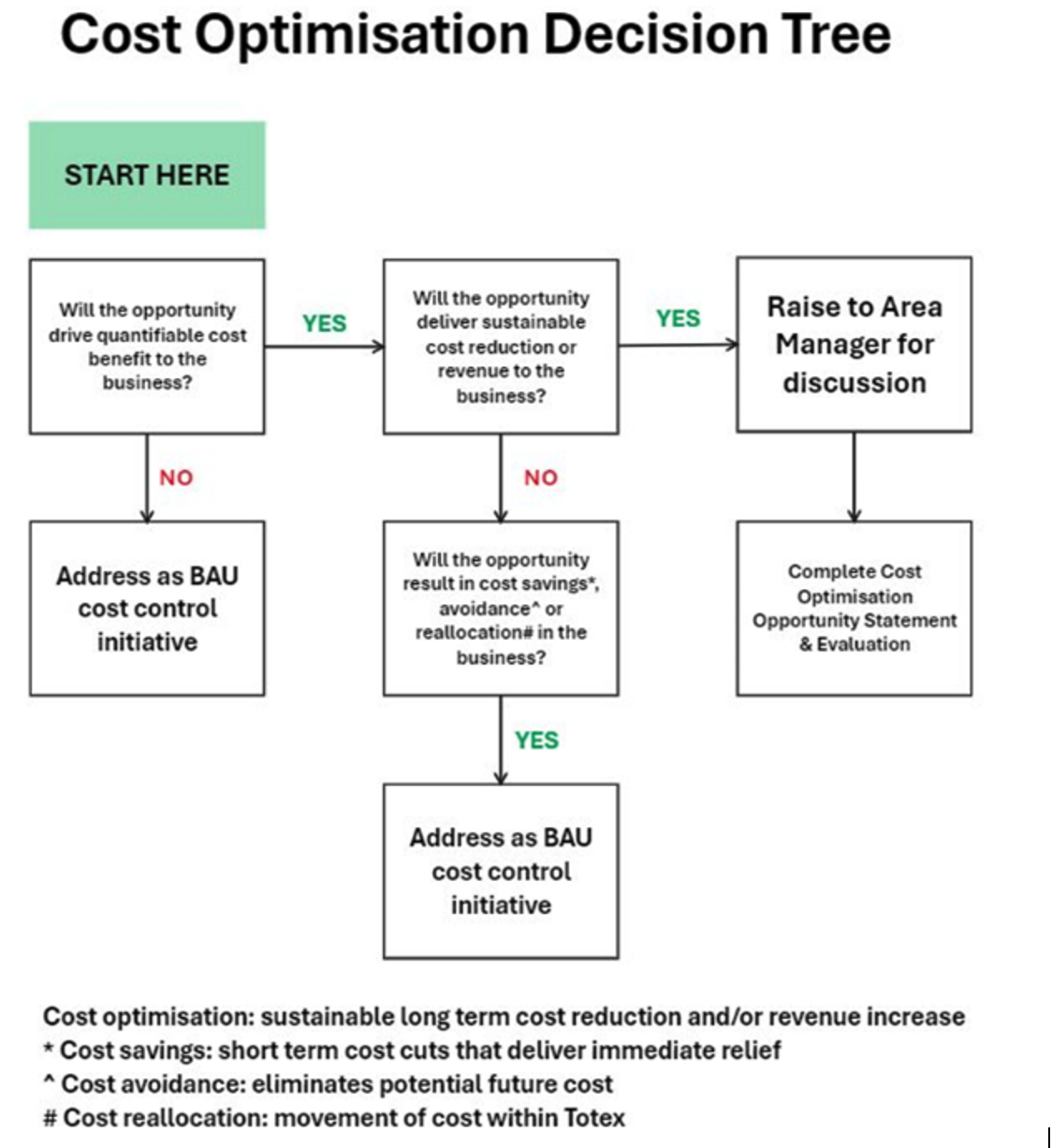

- Finance and business leads share “discovery” research into project feasibility. The team developed a decision tree (below) to understand whether a particular opportunity is cost-optimization or something that should be done as part of an employee’s day-to-day resource planning and management.

- FP&A quantifies the financial opportunity. “People are coming up with great ideas, but a lot of them aren't achievable.” A ranking tool is used for project prioritization.

- The business may need help to execute the project, perhaps an IT investment or support for implementation. That is NOT FP&A’s role. FP&A evaluates and helps identify metrics and measures for tracking the improvements and can advocate for the project and quantify their achievements.

- Many projects are complex and require cross-function work streams to execute; FP&A can assist in pulling together requisite skill sets — e.g., change management, project management, business analysts — to create cross-functional teams.

PROJECT EXAMPLE: FLEET UTILIZATION AND RATIONALIZATION

The Problem: In line with headcount increases, the frontline field team submitted a request for 120 new vehicles. FP&A had created a productivity and efficient dashboard pilot that suggested that vehicles were being “overused,” that more vehicles were being taken to jobs than was previously required for similar tasks, resulting in higher vehicle costs and reduced efficiency in unit rates. The FP&A analysis was based on available timesheet data; however, the business disagreed and said, “Your data's not trustworthy, you can’t use timesheets, and your utilization benchmark and targets are not correct.”

The Approach: The FP&A Team has a dedicated data analyst working with the vehicle fleet function and the technology team on a project to assemble and visualize the telematics data from the fleet. They accessed and analyzed the vehicle data to understand the when and how the vehicles were being used.

The team displayed the vehicle usage patterns visually, which became a powerful tool to present to the fleet custodians. With the larger dataset, they could show that crews were using vehicles with single riders rather than bringing a team into one truck. Digging deeper, they learned that existing performance metrics provided incentives for teams to do this, i.e., they were rewarded for high utilization of vehicles rather than economical use of vehicles.

The Outcome: The team identified the fleet could be rationalized by 143 vehicles, resulting in significant cost savings. Additionally, by addressing the root causes of fleet overutilization, the team was able to identify up to $2 million in potential efficiency gains. This also opened up the opportunity to review the metric framework for other unintentional consequences.

Alas, there are a number of unhappy members of the field crew who are emotionally attached to their vehicles, seeing them as “theirs.”

Outcome: What Came of FP&A’s Efforts and What Was Learned

Due to their capability and skills, FP&A is a crucial player in the process. “We've got the ability to provide the analysis and the visualizations, and we've also got the business partnering to connect functions or business units across the whole value chain, getting them to step up and help,” said the presenter. It was also key to establish a framework for when FP&A would get involved and when they would not.

The importance of looking at data correctly cannot be overstated. The team challenged existing metrics and norms by looking at different data sets, creating different analyses, and getting into the field themselves to see how the business works. “It’s about how you present the information and data to the business to help them understand where they can make a difference. We had utilization dashboards before, we just weren’t showing the data in a way they could relate to. It was ‘finance’s view,’” said the presenter.

With this approach to cost optimization, it is important to point out that process and analysis are not simply a way to cut expenses. “The flip side to this story is that the same information can be used to build a case to purchase more vehicles, particularly when we can show that jobs may be delayed or canceled due to lack of vehicle availability. Most importantly, we had to convince them that our role is to help,” said the presenter.

Cost optimization relies on defining what constitutes “good” performance. This is where finance can help, and senior management and the C-suite can play an active role, particularly when it comes to key decision points and overcoming resistance. Additionally, it is important to engage in regular reporting and communication in order to maintain momentum. Without consistent updates, there's a risk that the project will simply fade into the back of people’s minds.

Discussion Among Council Members

Why did FP&A own this effort and not consultants?

Over the past 10 years of restructuring and following the advice of various consultants, I have found that the results don’t stick — this is also supported by research! In my experience, when a consultant comes in, they always come to FP&A anyway. They always take my team's time by asking us to facilitate gathering information and analyzing data, come back to us to make sure they've got the interpretation correct, and then they take that knowledge away. This time, I made sure that if this was going to happen to my function anyway, I would direct the effort. I've also got enough experience now that we can do the work and keep the knowledge in-house and, therefore, maintain momentum. I have also built up my resources by adding two data analyst teams. They're not accountants, but they're the people who know how to get into the information and visualize it.

How do you evaluate costs? Do you look at fixed or variable, operating or capital?

We look at everything because we want net efficiency across the whole business. It might correlate to being a fixed cost or an indirect cost because they're easier to target and home in on. In the fleet example, that is a direct cost into all of our operations, and the allocation methodology could hide it in a unit rate, in capital expenses or in operating expenses.

Rather than targeting the categorization or trying to track it through to where it lands after allocation, we've gone for the input cost to the business.

What is the profile or skill set of the project manager?

It is really tricky because this is not a normal project manager role or program manager role. This does not have an investment to manage or report on, it isn't a linear approach or even agile, and there’s no project team to manage either. I've hired a person who's not an accountant but has worked in financial services and HR, has experience in transformation and business restructuring, as well as an understanding of contracts.

She said the hardest part of her role is figuring out how to mobilize a team to make this change. I told her finance is not here to implement the changes; we're here make visible where the opportunity is and help the business understand where the capability lies to make change. The business needs to be accountable for making it happen in order to embed the mindset of sustained cultural change.

It seems that cost optimization surfaces new information or reports in different ways because you're fundamentally changing the status quo, and you have to build that support.

Maybe the information exists and it's just showing it in a different way. Maybe it is creating a different context for the information or having people's minds primed to listen. Maybe it is ensuring they don’t feel that finance is coming out and telling them what to do but getting them to see that they are the ones who can make a difference.

Is there a role for AI in this project?

Not initially, no. It needs the human element to understand what you're seeing. We found that broken processes led to a lot of data gaps and non-standardized data, so the AI is not going to help you.

For instance, regarding a different project, when we have an emergency event like a cyclone or faults on the network, the crews often turn in manual data sheets which are entered into systems when they return to the depot. We had masses of information gaps and delays relating to assets that had been replaced.

My team had to go out and speak to people to find out where the break was in the process. The person responsible for entering the information just said, “Oh, well, I'm too busy; I'm doing other things.” We explained the importance of the information, and following that, the fault response information went from 97% noncompliance from data sheets to 3% noncompliance within a month. And that’s why you need people.

Why doesn’t this sharp attention to cost happen without someone imposing it?

That's a good question. We'd been flagging it for over 18 months, I'd been presenting it, the CFO saw it, we'd been talking about it, and it had become very clear in our previous budget cycle, and it still didn't cut through. It took our CFO saying, “I'm now putting targets on you all and your functional costs.” And that's when people started to come to the party. It lacked urgency, and the business felt like it was a finance problem. That's why I'm hoping to change the mindset of accountability to get beyond “it's a CFO's problem.”

It’s our role to help create that connection point and show them visually how they can impact it and how their decisions will impact a financial outcome.

How do you maintain good partnerships when you are essentially the ones mandating the change and pushing it through, and then, as you said, you're challenging budgets and squeezing out extra costs?

This is where relationship and partnership skills are so important. When we started it, I'd go out with reports, and they just shut us down by saying our data was wrong. My area managers are building relationships and building trust. We have had more conversations to help them understand what we are seeing and explain how they can improve their productivity. We are providing transparency and visibility and creating that link from putting a pole in the ground to our financial success. “Help us help you” is actually what we're trying to say.

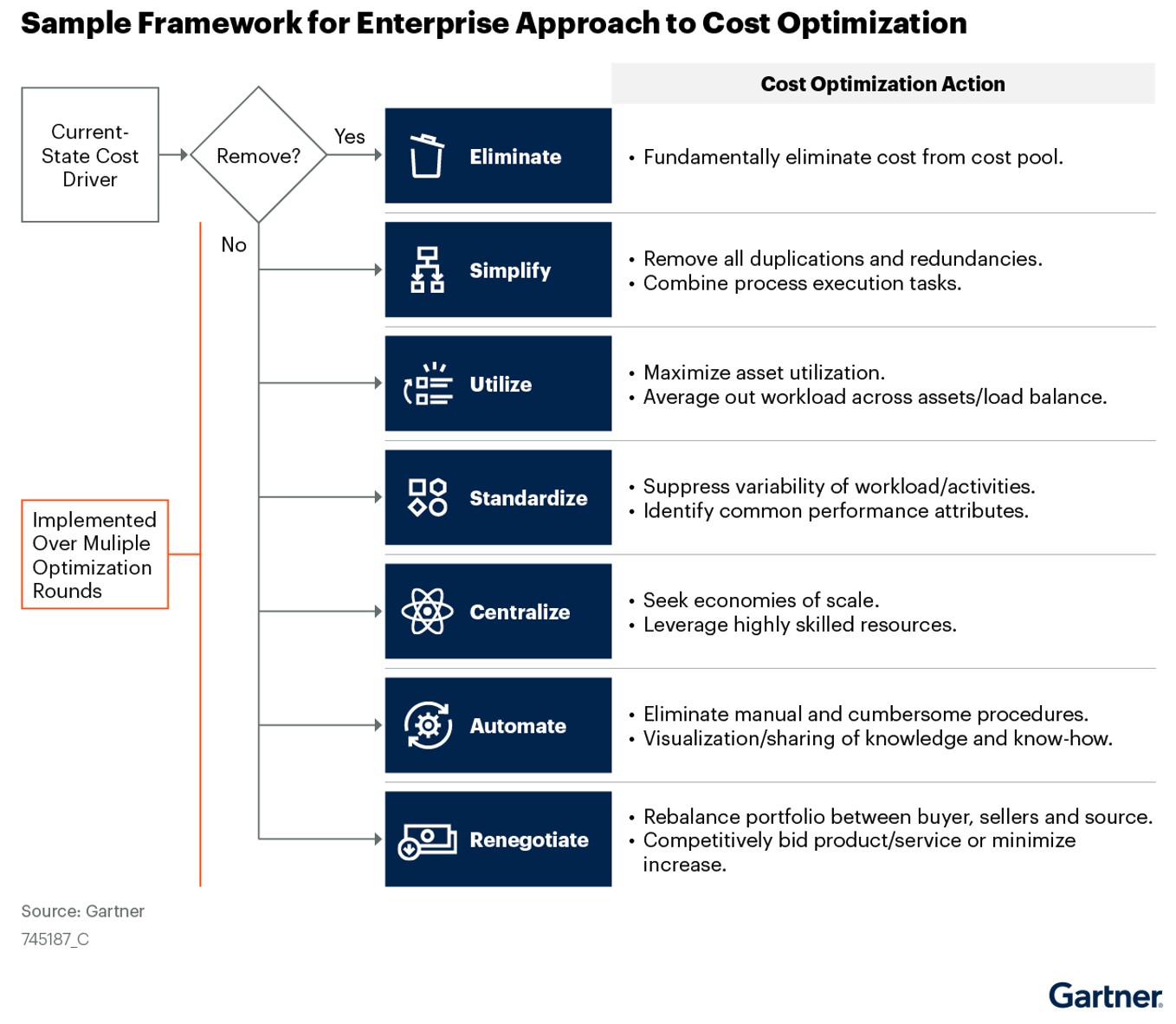

The following is another framework from Gartner that is useful in evaluating cost-out options:

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.