Articles

Finance Leads Cost Optimization Through Transformation

- By AFP Staff

- Published: 9/6/2024

This case study explores a strategic approach focused on value efficiency. The company’s initiative aimed to maximize the benefits and value derived from its existing resources and focus on the overall efficiency and effectiveness of its operations to create a comprehensive, cost-optimization strategy that delivers sustained value over time.

The AFP FP&A Case Study series is designed to help you build up key FP&A capabilities and skills by sharing examples of how leading practitioners have tackled challenges in their work and the lessons learned.

Presented at an AFP Advisory Council meeting, this case study contains elements that are anonymized to maintain privacy and encourage open discussion.

Insight: A structured approach to improving your expense margins includes looking for opportunities in cost reduction, cost avoidance, and operational transformation and efficiency.

Company size: Medium

Industry: Automotive

Geography: Middle East and Africa

FP&A Maturity Model: Finance and Financial Processes

Background: General Information About the Company

The company at the center of this case study is an automotive retailer specializing in new vehicle sales and after-sales support, such as maintenance and repairs. They offer a broad selection of vehicles from multiple original equipment manufacturers (OEMs). These are established partnerships backed by a renewable five-year distribution agreement that started in 2015, ensuring they have a steady supply of vehicles and the necessary support to offer their customers comprehensive and reliable after-sale services.

The following narrative was presented by the company’s finance director.

Challenge: The Work or Difficulty FP&A Had to Address

The company identified five significant challenges to increasing profitability in a risky and competitive market environment:

- Stagnant revenue growth: At 0.2%, the company’s revenue growth was minimal, owing to market saturation, intense competition, an ineffective marketing strategy and pricing challenges.

- Rising cost of goods sold (COGS): The COGS increased by 5%, putting pressure on the margins. Supplier price hikes, higher freight costs and increased costs within the production team drove the increase.

- Soaring finance costs: Finance costs rose by 189% to represent 1.7% of sales and indicating a significant cash flow problem. The primary reason for the increase was slow receivable collection. Addressing the issue required implementing a stricter credit policy and enhanced collection efforts.

- Marketing spend effectiveness: Marketing spend reached a high percentage of sales, reflecting a substantial rise in absolute value. Whether this increased spend correlated with a rise in revenue required close assessment.

- Rising operating expenses: Selling expenses increased by 21%, while general and administrative expenses surged by 87%, accounting for 1.1% of sales and further straining profitability.

The company needed to take decisive action to improve growth, enhance margins and optimize costs to achieve long-term financial stability.

Approach: How FP&A Addressed the Challenge

The FP&A team started by communicating a clear objective: to maximize the value of every resource while avoiding unnecessary expenses.

The strategic initiative they adopted centered on cost optimization, with the goal of improving profitability and operational efficiency without sacrificing long-term growth.

The initiative consisted of three parts:

- Cost reduction: By scrutinizing various expense categories, the team identified areas where spending could be reduced without compromising quality or performance and immediate cost savings could be achieved.

- Cost avoidance: Proactive measures were implemented to prevent future cost increases and ensure that the company could sustain financial discipline in the long term.

- Cost transformation and efficiency: Optimizing processes and systems was critical to ensuring long-term cost efficiency.

The FP&A team began by identifying the root causes of the company’s financial strain, including supply chain bottlenecks, inefficient marketing campaigns and customer payment delays. Through collective brainstorming, they developed creative solutions to reduce costs and stimulate revenue growth. A clear and measurable action plan was then developed, with specific goals and deadlines to ensure alignment across the team, as well as a framework for tracking progress and maintaining accountability.

Several considerations had to be addressed prior to implementation of the initiative, including:

- Cost-benefit analysis: Before implementing any cost-saving initiative, Finance led a thorough cost-benefit analysis to ensure the project value and prioritize the initiatives.

- Communication and change management: Business leaders communicated the cost optimization plans to stakeholders and addressed concerns – especially those related to job cuts.

- Employee training: The company provided employees with necessary training on the new processes or procedures being implemented.

- Performance monitoring: Finance would monitor and adjust the expected effectiveness of cost-optimization initiatives.

The company identified 20 projects as part of this effort, and one is highlighted below. A senior-level steering committee met every quarter to provide oversight, accountability and resources. At the working group level, a project team met monthly to share progress, align workstreams, and address obstacles.

PROJECT EXAMPLE: PARTS AVAILABILITY

A significant issue in the automotive retail industry is parts availability. It is both costly and difficult to manage but crucial for maintaining the company’s reputation. Local regulations require companies to compensate customers if parts are not delivered on time and may pay fines to the government. To avoid these penalties, the parts team started using expensive delivery methods, such as ordering parts via air freight or using DHL’s door-to-door delivery service — which significantly increased costs.

Cost-benefit analysis:

The landed cost factor (total price of a product or shipment including fulfillment to the buyer's door) had traditionally been 1.18x the product cost, but it increased to 1.25 over the years. When the company started using air delivery, the cost factor rose to 1.38, which meant operational costs increased substantially, affecting both efficiency and part availability.

A thorough process review was conducted, and it was discovered that the root cause was poor planning, largely due to a reliance on manual processes and Excel spreadsheets, which was then coupled with inadequate storage capacity at their facility.

Communication & Change Management

Two initiatives were implemented to resolve these issues:

- Larger order sizes by sea: To reduce costs, they decided to place larger orders shipped by sea rather than relying on expensive air freight.

- Enhanced planning and ordering system: They invested in staff training so their staff could utilize their existing planning and ordering system fully.

The company set a target to reduce the landed cost factor from 1.38 to 1.30 within the first year of implementing these changes.

Employee Training

Implementation took six to eight months, a timeline driven by the need to order large quantities of parts from China, which required at least six cycles of planning and ordering. Additionally, the team needed training, and much of the process was initially manual.

The company had three ordering teams to start, but by more effectively leveraging its system and technology, they were able to reduce this to two teams — without layoffs. The third team was reassigned to another operation in logistics.

Performance Monitoring

The results of these changes include:

- Increase in parts availability from 80% to 92%.

- Reduction in landed cost factor to 1.3 — and on track to meet their next target of 1.25.

- Reduction in cost of manpower for planning and ordering by nearly 30%.

- Decrease in fines and compensation paid to customers and the government (though they did incur higher rent costs due to additional storage space at one branch).

Outcome: What Came of FP&A’s Efforts and What Was Learned

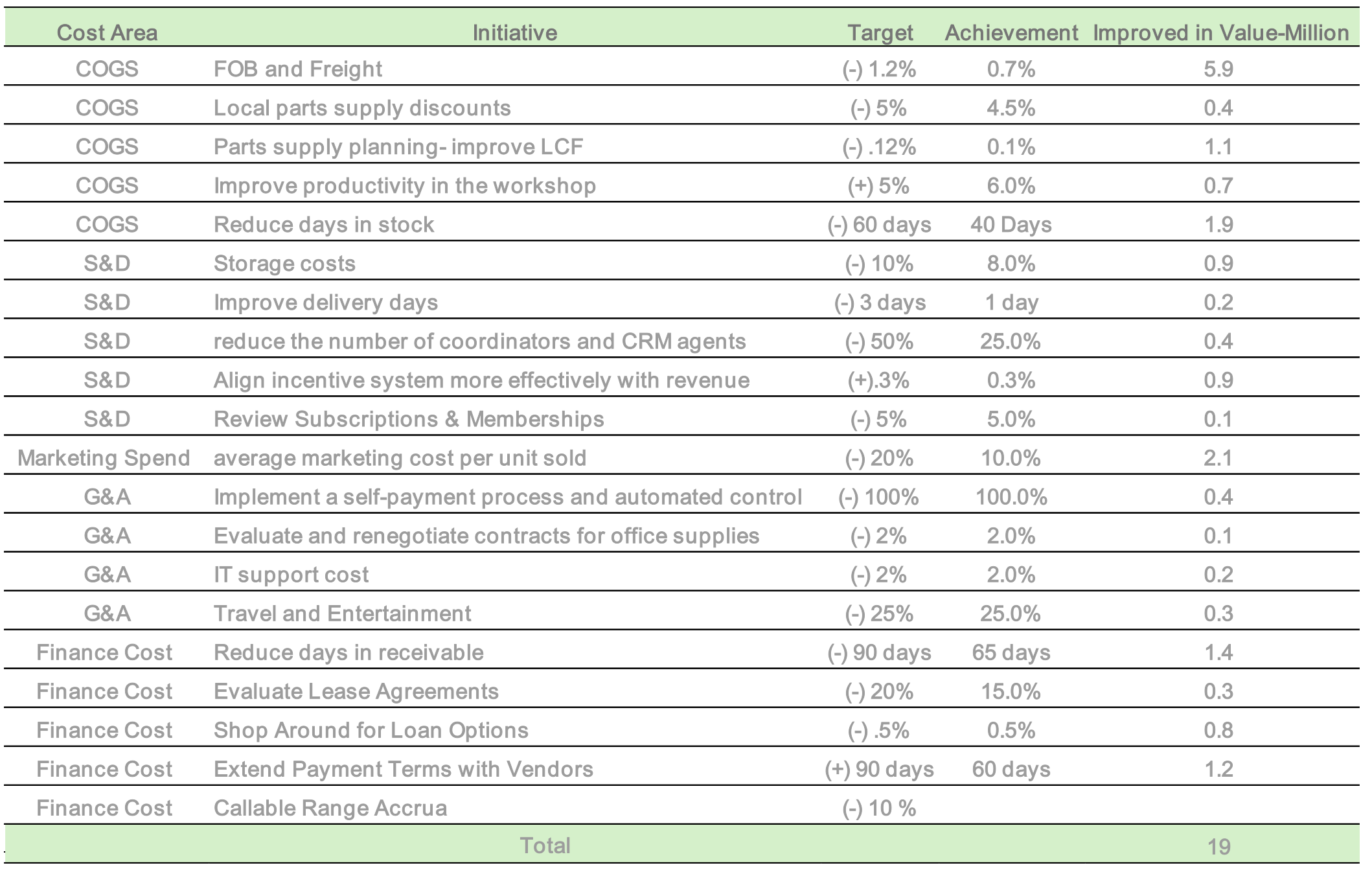

In total, the 20 cost optimization efforts led to a substantial $19 million increase in profitability. By focusing on reducing the days of inventory and days of receivables, they were also able to see improvements in their cash flow and enhancement of the cash cycle. Further, their overall performance and competitiveness in the market improved.

In essence, the strategic approach implemented led to:

- Improved profitability through reduced expenses and increased efficiency.

- Increased cash flow through better collection practices and effective inventory management.

- Enhanced competitiveness by offering competitive pricing while maintaining strong profit margins.

Discussion Among Council Members

Companies often hide cost cutting behind cost optimization, and therefore effective communication is key to credibility and ultimately success: “You have to be honest about what you are doing and communicate with the team that. In our effort, we said perhaps we might stop hiring extra people, but we are utilizing the existing resources, and no one will lose a job due to this.”

Another council member recalled a time when they joined an organization with losses and low margins: “My CFO and I elevated the data visibility on all the key costs of the P&L that were driving the losses, such as a truck's rental cost, employee cost, and transportation clearance costs. Then we calculated the percentage of revenue or productivity measures (e.g., costs per order of delivery) and created trend lines.” Next, this member asked stakeholders for their forecasts for the upcoming months, forcing them to take ownership of their P&Ls and expenses. This pushed them to make plans to deliver better numbers. Going from a general cost pool discussion to understanding the key drivers of cost was critical.

A third council member discussed the need to break the inertia of the existing reporting. “People are going to optimize based on the financial and management reporting that's out there; everyone is used to looking at numbers and all reports one way,” they said. “But if you shake up the data, show a new analysis, or look at a process based on an end-to-end, we can show you a need that was not visible from the reports you've been receiving every period for the last X years.”

Cost optimization efforts can also lead to new processes or technology. People need a push to overcome inertia and resistance to change. Maintaining the benefits of cost optimization requires a change in behavior, so people don’t go back to the old way of doing things.

Copyright © 2025 Association for Financial Professionals, Inc.

All rights reserved.