Articles

FP&A COVID-19 Survey: Additional Visibility For FP&A

- By Bryan Lapidus, FP&A

- Published: 5/20/2020

The coronavirus crisis requires an “all hands on deck” response as companies pass through various phases of crisis response, transition, and settling into a new operational phase for the foreseeable future. For the FP&A team, this has meant long hours, significant coordination, and new level of visibility. The 2020 FP&A COVID-19 Survey examined how FP&A practitioners have been supporting their business partners and adding value throughout their enterprises.

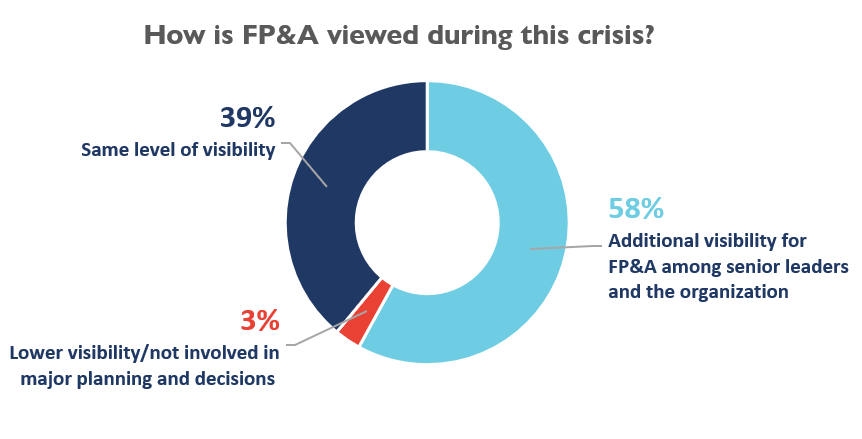

Nearly six out of ten practitioners report that FP&A is getting more exposure to senior leadership as market uncertainty has led companies to explore multiple scenarios, evaluate response options, and reforecast as assumptions change. The reduced cycle time to produce information, and increased detail required to explain the models and assumptions, are providing FP&A with opportunities to present directly to leadership. In the past, the message might have been filtered through the CFO. One respondent sees this as a permanent change; going forward, “FP&A will be highly involved in hypothetical scenario planning with increased senior leadership collaboration.”

FP&A professionals noted that they were taking part in an unending task of analyses and sensitivities; nearly one in three practitioners are producing a reforecast every day. This may sound trivial, but as Jack Alexander noted in his video interview, FP&A needs process discipline when developing and evaluating forecasts and scenarios. There are an infinite number of scenarios and a finite amount of time. At some point, you reach diminishing returns and are expending effort that could be applied to other useful activities, Alexander explained.

The survey examined FP&A’s other activities, with results shown in the table below. The leading activity was to help run business continuity exercises and to plan corporate responses. The second most cited activity was increased reporting, which in this circumstance means to provide more actionable information to the company.

These responses highlighted several distinctions between companies based on size. Larger companies with revenues more than $1 billion were more likely to use FP&A to reprioritize growth initiatives and include FP&A in a “command center.” Those same larger corporations were less likely to have FP&A involved in sourcing capital or negotiating terms with vendors or customers, perhaps due to increased specialization with finance at those companies.

A separate set of questions specific to manufacturing companies revealed that FP&A has less involvement in various supply chain initiatives. Consistently, about one in three manufacturing respondents indicated FP&A are evaluating facility closures, creating protected work zones, and rationing components among products.

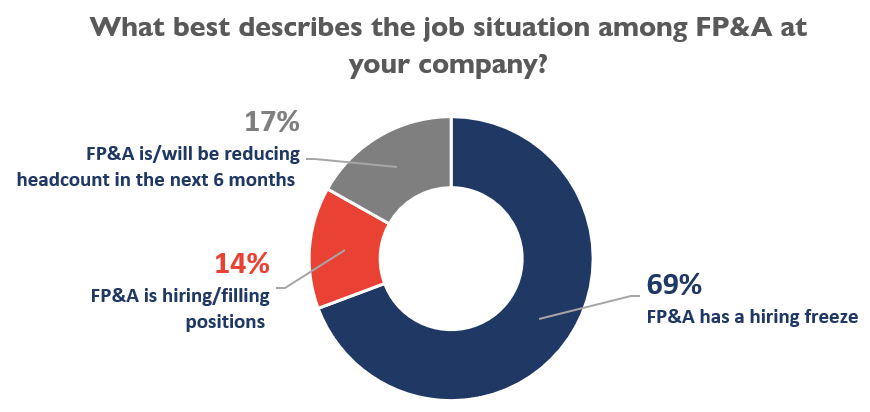

Given the increased visibility and workload, the job outlook for FP&A seems stable, which may be a positive sign given turmoil in the job market. Respondents anticipating position reductions are offset by those anticipating hiring, and the overwhelming majority expect no change in the number of FP&A positions as their companies are restricting hiring.

Overall, the picture emerges that the pre-crisis trend of finance and FP&A as critical partners to leadership and the business will accelerate. The uncertainty sparked by this crisis will likely lead to additional emphasis on scenario planning, speed of incorporating market data and agile responses, which means the best FP&A organizations will be able to prosper in coming era. As one respondent said, “The companies that have made an investment in FP&A have a stronger ability to respond and make decisions during various economic situations.”

To access other articles and information relating the survey, please visit www.afponline.org/covid19FPA.

Register for the webinar: “What COVID-19 Means for FP&A” on June 11th.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.