Articles

Global AFP Service Codes Committee Review

- By Bridget Meyer, Senior Director at Redbridge

- Published: 10/6/2023

In collaboration with the SWIFT CGI-MP, the Association for Financial Professionals has published an updated version of the AFP Global Service Codes used in all ISO 20022 bank fee reporting files.

Recognized as the global standard by more than 30 of the world’s largest commercial banks, the AFP Global Service Codes, when included in bank billing camt.086 or TWIST file formats, provide transparency into their costs for cash management, trade, and card services across their banking network.

The last update to the code set was in 2018, and feedback from the community revealed that it was necessary to improve the code set to properly reflect today’s rapidly evolving treasury services market. The AFP recently published a major update to the AFP U.S. Service Code set used only in the U.S. and some Canadian markets. To ensure consistency across code sets an update to the Global Service Codes was needed.

The CGI-MP Working Group 5, dedicated to ensuring consistent global adoption of the ISO 20022 billing file format, formed a task force with representatives from major banks like JP Morgan, Deutsche Bank, Standard Chartered, Societe Generale, Commerzbank and BNP Paribas. Participants completed a three-month-long project of reviewing and updating 1133 active service codes. “After recently leading the taskforce to update the U.S. version of the service codes in 2021, it became urgent to update the global codes to be consistent and fill major gaps,” said Bridget Meyer, Senior Director at Redbridge and CGI-MP Working Group 5 chair. “We left no stone unturned.”

That commitment resulted in 189 new codes being added, as well as updates to 323 of the existing codes, with an emphasis on clearer definitions and mapping guidance for proper treatment of bundled and ‘undefined’ services.

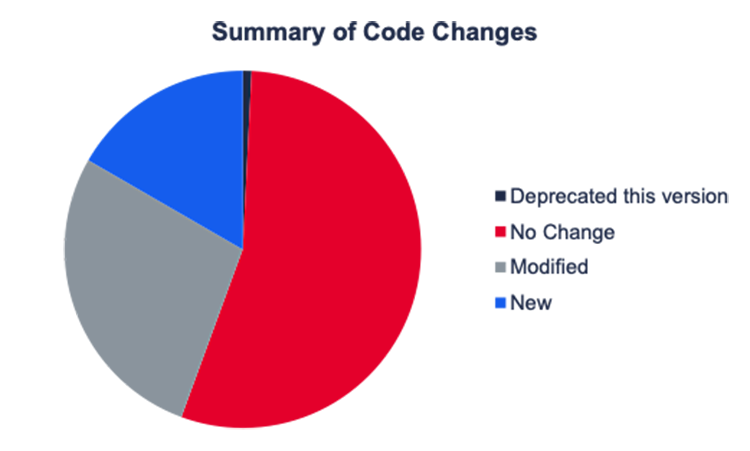

Figure 1 shows a breakdown of the update, and the following summarizes the changes in the latest release.

Figure 1

Modifications by Product Family

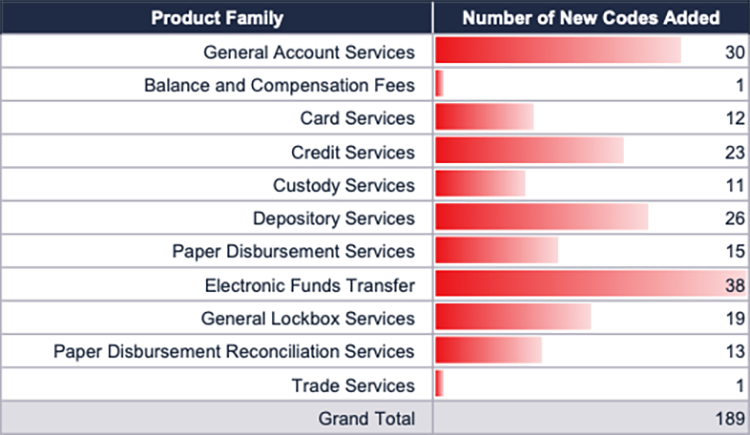

Not all products required updates; Information Services and Automatic Investment (Sweep) Services had no changes to the service codes. General Account Services and Electronic Funds Transfers, the two largest products in the code set, had the most updates. Figure 2 shows the number of new codes by product.

Figure 2

Account Services

Technological advances in fraud monitoring, artificial intelligence, APIs, and imaging are reflected in the following new product groups:

ACT331 Account Validation Services

ACT332 Artificial Intelligence Services

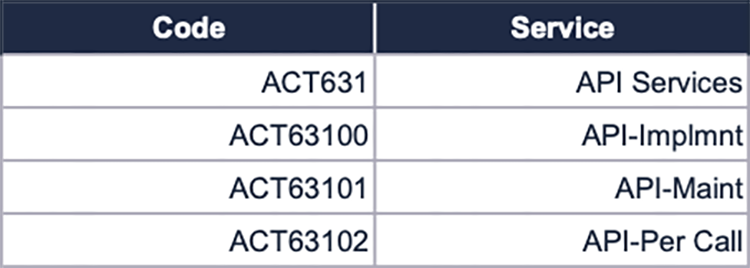

ACT631 Application Programming Interface (API) Services

ACT70 Imaging Services

Card (Prepaid, Corporate, Merchant Card/Services)

There is a movement globally to encompass merchant fee reporting under the ISO 20022 umbrella and leverage the camt.086 message type to encompass all fees charged by banks, not just cash management services. Therefore, the task force reviewed and improved lesser-used product families to make them consistent with the U.S. AFP code set.

Credit (LOC, Guarantees and Borrowing)

Though rarely seen in billing files, AFP does maintain many service codes to report fees related to revolving credit and lines of credit. New codes were added to include technical and financial guarantees, borrowing, and bonds and their reporting. Additionally, maintenance and posting fees related to banks’ ‘sweep to loan’ services, defined as automated borrowing, were added.

Custody

The Global and Domestic Custody product groups were updated for consistency to the U.S. code set, with the addition of new codes for Asset Level Fund Maintenance fees, as well as additional codes to track ‘Out of Pocket’ fees, custom programming, tax support, and others.

Depository Services

One of the largest product families, DEP Depository Services, added new product groups for deposit imaging, ATM and armored carrier services. Though cash is no longer king, new codes were requested and approved for maintenance fees for branch and bulk deposit processing, as well as for depository services being locally handled by third parties.

Electronic Funds Transfer Services

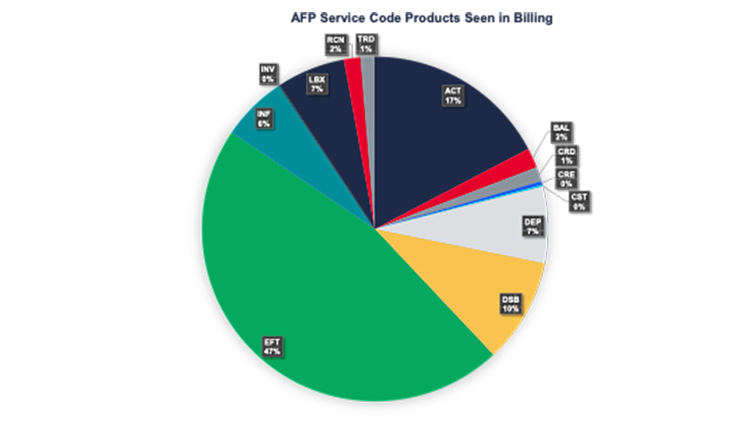

The global world of electronic payments has evolved significantly in the past five years, and payments keep getting faster. The largest product group by far, the EFT product family, represents almost 50% of all services charged by banks, according to the Redbridge Debt & Treasury Advisory’s global database (see Figure 3). Ensuring clear mapping for “urgent” payments versus “instant” or “real time gross settlement RTGS)” payments was a particular challenge to conquer in this code set.

Figure 3

New product group EFT17 was created for Instant Payments. This is defined by the EU Retail Payments board as “electronic retail payment solutions available 24/7/365 and resulting in the immediate or close-to-immediate interbank clearing of the transaction and crediting of the payee’s account with confirmation to the payer (within seconds of payment initiation).” Examples of Instant Payments are RTP, Faster Payments, Swish, TARGET Instant Payments, etc.

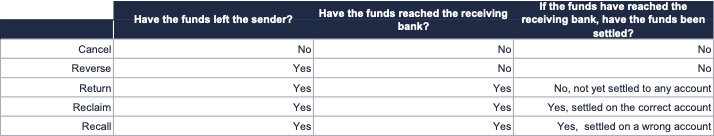

Payments are now defined and classified in the code set as one of the following transfers: Domestic, SEPA, Cross-Border, Instant, RTGS, Book or Intercompany. Charges are separated by whether they are initiated by the customer (outgoing) or received and processed on the customer’s behalf (incoming). Exception processing can also be extremely confusing, so the committee worked to clarify the differences between returns, reversals, recalls, cancels and reclaimed payments. The following table provided by members from Deutsche Bank, summarizes the distinction between each of these exceptions, which has now been clarified within the codes.

Table 1

The practice of charging for additional fraud prevention services, common in the U.S., has also been seen in recent years as a growing practice within Europe. As a result, the EFT302 product group was added for fraud exception notifications and processing, as well as additional Debit/Credit Authorisation Mandate maintenance and administration.

Paper Disbursements and Reconciliation

All changes made within the Lockbox (LBX), Paper Disbursement (DSB) and Paper Disbursement Reconciliation (RCN) product family were updated for consistency with the U.S. codes. Primarily in the U.S., but also in Canada and other key markets, cheques and other paper instruments are still being used. In line with its mission to rework all reporting services to be organized by delivery method (i.e., transmission, internet, electronic message, or manual) versus content within the report, the task force took great care to clarify reconciliation reports and other reports throughout the code set.

“Banks adopting the updated code set should pay attention to the additional information provided in the definitions of all modified and new codes. The task force added more direction within the descriptions, even provided examples, to help with the proper assignment of codes,” said Meyer.

Trade

Based on feedback from the CGI Work Group 5 Committee, the AFP service code TRD01200 Letter of Credit – Issuance has been deprecated as not relevant to export letters of credit.

Further clarification has been added to amendment and issuance service codes in addition to bundling “stamp duty” charges along with postage for mapping purposes.

Bundled Services

The treatment of bundled services, defined as when more than one AFP Code could be true, is different within the AFP Global Codes versus the U.S. AFP Service Codes. In the EDI 822 standard, AFP Service Codes must be 6 digits. Bundled services in a U.S. code use the letter Z to indicate where the bundling occurs (i.e., 01ZZZZ). The AFP Global Codes do not have this restriction; therefore, a legitimate code can be 3-8 digits long. Rather than using the letter Z, the AFP advises the bank to leave the digits blank and bundle at the header level (i.e., ACT631). To clarify this, header codes now have the following description, “use this bundled code when more than one code in the following group is true,” added in the 2023 version.

Undefined Services

Similarly, proper treatment of an undefined service in the U.S. code set requires one to replace the digits that are “untrue” with the number 9 (i.e., 010199). In the Global Service Codes, banks should shorten the code and stop where the code becomes “untrue,” then add a single 9 to the end. Using Table 2 below, Global Service Code ACT6319 would indicate to the customer that the service charged by the bank is related to API Services but does not fit any of the definitions of the available codes in that product group. To help clarify this practice, the following statement was also added to each header: “If this AFP group applies, but no existing code in the following group is true, add a 9 to the end of this code.”

Table 2

In Summary

Almost all product families were affected by this update to the AFP Global Service Code set. Whoever chooses to use these codes internally for data analytics or pricing exercises, or externally, for an RFP or fee statements, can be confident that the best options are now available that reflect today’s global treasury environment.

When can you expect to see the changes to your billing statements?

AFP recommends banks make the necessary changes to their billing files by the end of 2024 and communicate the changes to their customers in advance. During this adoption period, it is incredibly important for corporate treasury teams to ask your banks which code set they are using and to adopt the new code version.

AFP Service Codes Accredited Providers will be updated during their next renewal cycle.

About the AFP Service Codes

There are two different sets of AFP codes used by the financial industry: AFP Service Codes and AFP Global Service Codes.

AFP Service Codes are industry standard codes assigned by all major banks to their cash management services and billed to large corporations on their account analysis or bank fee statements. Proper assignment of the codes allows a corporate treasurer who uses multiple banks to perform analytics, cross-bank comparisons and RFPs effectively. Today with big data being king, and every corporate and bank alike looking to implement business intelligence (BI) tools, classification of data is not only necessary — it is critical to the success of the analytics and insights expected in these projects.

The AFP Global Service Codes were created in 2011 and most recently updated in 2018. The global codes were designed specifically for the international community, based largely on the original AFP Service Codes created in the U.S. for use in the ASC X12 EDI 822 standard in 1986. In the U.S., over 800 mid- and large-sized corporations currently receive their bank analysis statements electronically using the ANSI X12 EDI 822 Transaction Set in which the U.S. AFP Service Code is a mandatory field.

The Global AFP service codes are accepted in the market as the standardized bank billing code set worldwide. Members of the CGI-MP W5 group from various global banks, software venders and corporations maintain the camt.086 file standards and periodically review the code set to suggest changes to the Association for Financial Professionals to keep the services codes relevant to today’s environment.

The Global AFP Service Code set includes 1124 independent treasury services organized into 13 treasury product families to date. The Global AFP Service Code set structure was designed for TWIST BSB or the ISO 20022 camt.086 files. Redbridge Debt & Treasury Advisory currently leads the CGI-MP Working Group 5 taskforce dedicated to a common global implementation of the international bank fee reporting (ISO 20022 BSB) standard. For comments on improvements needed to the code set, to the camt.086 standard, or to participate in the CGI-MP taskforce, please contact Bridget Meyer at bmeyer@redbridgedta.com.

The committee assigned to review the global set recommended the addition, modification and deprecation of all service code changes in the 2023 release. All changes were approved and published by the AFP and are noted within the “Status” column of the official AFP Global Service Codes available for download to paid subscribers.

Copyright © 2025 Association for Financial Professionals, Inc.

All rights reserved.