Articles

Numbers and Narratives: Where Story Meets Valuation

- By AFP Staff

- Published: 6/12/2024

“A good valuation cannot just be about numbers, and it can’t just be a fairy tale,” says Professor Damodaran.

“A good valuation cannot just be about numbers, and it can’t just be a fairy tale,” says Professor Damodaran.

Yet, from an early age, people are divided into two camps: the number crunchers and the storytellers. Each side stays in its preferred habitat, speaking its own language, convinced that the other group is wrong. “What I’d like to propose is to start bringing the two sides together because if we don’t, we are going to create some mistakes that are going to cost us all.”

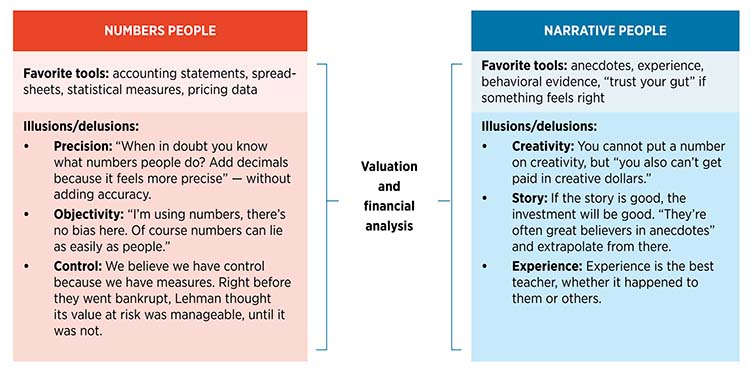

Damodaran explains the anatomy of the two groups and how they approach financial analysis, emphasizing the shortcomings of each side that lead to an incomplete picture:

Finance tends to be dominated by the numbers people, which means when we do our financial analysis, we are surrounded by peers who look at numbers through the same training and see the world the same way. This amplifies the three most significant challenges in valuation that befall the quants among us:

- Bias. When we sit down for valuation work, we generally have a preconceived notion of how things will work out. Damodaran explains when operating with bias, “I write down what I think I’ll find in the valuation and what I think about the company before I look at the numbers.”

- Uncertainty. We don’t like uncertainty and tend to deny what we don’t know. “Here’s my advice,” says Damodaran. “Don’t hide from it. Face up to it. Look it in the eye and admit you don’t know what the growth rate is. I’m going to try to make my best estimate. I’m going to be wrong.” And then, be willing to change when new information comes in.

- Complexity. “Valuation and financial analysis have become an exercise in financial modeling,” says Damodaran. Spreadsheet models may run to hundreds of lines across a dozen worksheets, and that has missed the story of the company.

To combat these challenges and overcome the illusions/delusions, Damodaran has put together the following process to harness the strengths and minimize the weaknesses of both the numbers and narratives people:

“We need more renaissance people who can go back and forth between numbers and narratives,” says Damodaran. Good financial analysis requires both sets of skills as practitioners and business partners. For example, it is finance’s job to listen to stories without denying what our business partners are saying; instead, we flesh out the stories, convert those stories into numbers, and challenge them as appropriate. This requires a common language because neither side has a monopoly on truth.

This approach will become more critical to finance practitioners as AI becomes more prevalent. “You can already see number crunching as a skill is only going to get more diluted over time,” says Damodaran. “A machine can always out-number you and me. The number crunchers must learn to write, read, communicate and convert their numbers and the stories, and the storytellers must learn to work with numbers until they get comfortable. My advice is to become more balanced people.”

Based on Professor Aswath Damodaran’s FP&A keynote presentation at AFP 2023, this article is an excerpt from the AFP FP&A Guide to What Is Financial Analysis. Damodaran is the Kerschner Family Chair in Finance Education at the NYU Stern School of Business and an expert on financial valuation.

Copyright © 2025 Association for Financial Professionals, Inc.

All rights reserved.

![Synovus Logo Red UMB Bank Vert Full Color CMYK[2]](/images/default-source/sponsor-ads/synovus-logo-red-01-37.png?sfvrsn=9a15e66b_0&MaxWidth=140&MaxHeight=140&ScaleUp=false&Quality=High&Method=ResizeFitToAreaArguments&Signature=75D52A4BE2DCD79C83D452F518A46F3219CD2F81)