Articles

Understanding Foreign Exchange Risk

- By AFP Staff

- Published: 3/25/2024

Foreign exchange risk is the possibility that fluctuations in exchange rates between currencies will lead to financial loss.

More commonly known as FX risk, foreign exchange risk is an important part of global treasury management. The primary goal of global treasury management mirrors that of its domestic counterpart: effectively utilizing an organization's worldwide cash reserves to align with its strategic vision. However, global operations introduce distinct complexities, such as managing funds across borders and employing specialized techniques for handling currency fluctuations and cash flow.

How to Calculate FX Rates

Calculating FX rates involves understanding two key concepts: the base currency and the quote currency. The base currency is the currency being measured or valued, while the quote currency is the currency in which the value is being expressed.

Foreign Currency Quotation

FX rates, also called spot rates, are quoted in different formats depending on the currencies and markets involved. An FX rate shows how much one currency is worth in terms of another currency at a specific point in time.

Bid-Offer Quotes

Banks and dealers provide bid and offer rates for foreign currency. The bid rate is what they will pay to buy currency, while the offer rate is what they will charge to sell currency. The difference between these rates is called the bid-offer spread.

How FX Rates Are Obtained

The majority of companies involved in FX markets use real-time rate reporting services. And those trading in the FX market typically access rates via banks, FX dealers or online platforms.

Rates are also available online for free, but they may have a slight time delay — treasury professionals should be mindful of these delays, which can range from 15 minutes to 24 hours. Rates can also be obtained directly from banks or FX dealers by phone or email, but be sure to cross-check them with other market data sources.

Get an overview of topics that are crucial to treasury professionals who are performing the international treasury function with the AFP Digital Badge: Foreign Exchange, complimentary to members. Not yet a member? Join AFP to access the full library of Digital Badges, mini-courses and more.

How FX Transactions Are Settled

The settlement of FX transactions occurs when the agreed-upon currencies are exchanged between parties — that is, if everything goes as planned. Unfortunately, the process exposes both parties to settlement risk whereby one party makes the exchange using the agreed-upon currency, and the other does not, causing the transaction to fail. This can have significant consequences, even in the short term.

Banks use a system called continuous linked settlement (CLS) to minimize the risk. CLS is a multicurrency settlement system that enables simultaneous settlement of FX transactions across multiple currencies. It operates on a real-time gross settlement basis, where each transaction is settled individually and immediately upon matching, eliminating the risk of settlement failure due to counterparty default.

Spot Rate vs. Forward Rate

There are two primary FX markets: spot and forward. The spot market involves immediate currency exchange, settling within one or two days. The forward market offers rates for future delivery, beyond spot contracts.

Forward rates, based on spot rates, include forward points reflecting interest rate differences between currencies. These points show how interest rate disparities affect currency values over the contract term. If a settlement period is set beyond one year, a forward contract may be used, depending on a company's FX risk exposure.

The forward rate, or the rate at which the two currencies will be exchanged, is determined by three factors:

- The current spot rate

- The term of the forward contract

- The current interest rates.

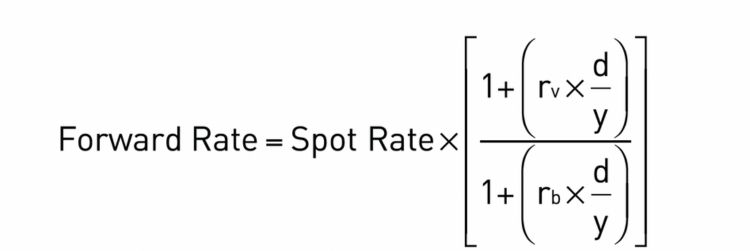

The formula used for calculating the forward rate is:

Where:

rb = Base currency interest rate

rv = Variable currency interest rate

d = Number of days in the period

y = Number of days in the year

The forward rate can also be calculated using the difference in basis points between the two applicable interest rates. The interest rate differential determines whether the currencies will trade at par, at a discount or at a premium in the forward market.

- Par: The spot rate and forward rate are equal. This suggests that the yield curves of both currencies are identical, though this is rare. Typically, currencies trade at a discount or premium.

- Discount: When a currency is worth less in the forward market than in the spot market, the currency with a higher interest rate trades at a discount against a currency with a lower interest rate.

- Premium: When a currency is worth more in the forward market than in the spot market, the currency with the lower interest rate will trade at a premium against a currency with a higher interest rate.

- Points: Premiums and discounts are often measured in points. In industry terms, forward points are added to the spot rate for premiums and subtracted from the spot rate for discounts.

Currency Derivatives to Manage FX Risk

When a company identifies significant risks from currency exchange rate changes, there are several different tools it can use to handle FX rate risk.

Currency Forwards

A currency forward is an agreement to buy or sell a set amount of foreign currency on a future date at a predetermined exchange rate. They are widely available through banks and FX traders in major currencies and common maturities.

Given their over-the-counter nature, currency forwards can be tailored for various currencies and maturities with willing counterparties. Typically, banks act as dealers or counterparties for forward contracts, necessitating legal documentation, such as an ISDA master agreement, to address credit-related risks. Standard forward contracts settle on the agreed settlement date with an exchange of the specified currencies.

There are three types of currency forwards:

- Window forward: Settlement doesn’t happen on a fixed date. Instead, it occurs within a specified period or “window” of time. This provides flexibility for handling possible production or legal delays. However, window forwards usually cost more than standard forwards because the counterparty doesn’t know the exact settlement date, and prices are based on the worst-case scenario.

- Average-rate forward: Used when a hedger plans to trade funds in the future but doesn’t know the exact dates or volumes of the trades. For example, it could hedge daily sales receipts over a month. This forward lets the buyer set a hedge rate for this unknown future exposure by locking in forward points and a spot rate today. Later, during a specified period, daily spot observations are averaged to determine a rate. If this average rate is different from the hedge rate, a payout is set.

- Non-deliverable forward (NDF): Commonly used for exotic currencies when they’re not actively traded in the forward market. NDFs settle in major currencies, like USD or EUR, and act as proxy hedges, mimicking movements of the desired currency. Settlement is based on the difference between the agreed NDF rate and the spot rate, without involving actual currency exchange. For example, assume a Canadian company is importing products from China. The company is billed in Chinese renminbi (CNY) but pays its invoices in US dollars. The company can use a USD/CNY NDF to hedge against USD/CNY rate changes.

Currency Futures

Currency futures provide a means for companies to secure FX rates for a specified duration, offering the flexibility of early closure while necessitating careful margin account management. Traded on organized exchanges, such as the Chicago Mercantile Exchange, these contracts are standardized in size and maturity and are subject to mark-to-market valuation, requiring margin accounts to manage potential fluctuations in value.

Traders can leverage their margin accounts to purchase contracts and repay the loan upon settlement. The contract sizes vary depending on currency pairs, typically with six-month maturities on a quarterly cycle, and settlement often involves closing positions before maturity, with remaining positions settled quarterly. Any expired positions are settled based on the contract’s value.

Currency Swap

Companies use currency swaps to manage currency risk for anticipated cash flows without natural hedges, such as when financing expansions or adjusting value dates for forwards due to unforeseen events. These swaps involve the exchange of cash flows and principal in different currencies, typically at fixed or floating rates and governed by ISDA master agreements. Payments are scheduled, including principal exchanges and interim payments based on agreed-upon interest rates, and the principal amounts are determined by the exchange rate at the contract’s start.

Currency Options

A currency option grants the purchaser the choice to either buy (call) or sell (put) a predetermined quantity of a foreign currency at a predetermined exchange rate (the strike price) on or before a specified future date. Currency options are used in three different ways:

- Currency cap: Sets the highest exchange rate for a specific transaction. It is used by companies to control the cost of future foreign currency cash flows in their operating currency. A currency cap is determined by adding the premium paid for the call option to the strike price.

- Currency floor: Establishes the lowest exchange rate for a specific transaction. It is used by companies to guarantee a minimum amount of operating currency for future foreign currency cash flows. A currency floor is established by buying a put option, which allows you to sell a fixed amount of foreign currency at a set rate in the future. The strike price of the put option, plus any premium paid, sets this minimum rate, ensuring the company receives at least that amount for its foreign currency.

- Currency collar: Creates a range in which an exchange rate may fluctuate. It is used to lower the cost of either a cap or a floor. To create an FX currency collar, choose a range for exchange rate movements by buying a call option for an upper limit and selling a put option for a lower limit. The strike prices and premiums set the collar’s range, offering protection against extreme changes while allowing flexibility within it.

Currency options require the payment of a premium, the cost of which should be considered based on the potential loss the option is designed to protect against. As the holder is not obliged to use the option, it’s a valuable tool for safeguarding against possible FX risks.

Why Managing FX Risk Is Important

Managing FX risk is critical for companies that operate internationally because it can directly impact their profits and financial stability. Because treasury is often a central clearinghouse for financial information in many companies, it is well-positioned to help manage FX risk, among other types of financial risk.

Managing a company’s risk helps to reduce the variability of both a company’s future cash flows and its profitability. Hedging enables treasury to smooth uneven cash flows due to unexpected external changes and forecast financial results with greater confidence.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.