Additional unbiased content that helps you navigate innovative treasury and finance trends, topics and technologies.

2023 AFP and Zanders Whitepaper: The Future of Corporate Treasury Teams

In collaboration with Zanders

The Newly Released 2023 AFP® and Zanders Whitepaper: The Future of Corporate Treasury Teams, looks at the evolution of the treasury function and the factors that directly impact the skills needed to build a successful team.

-

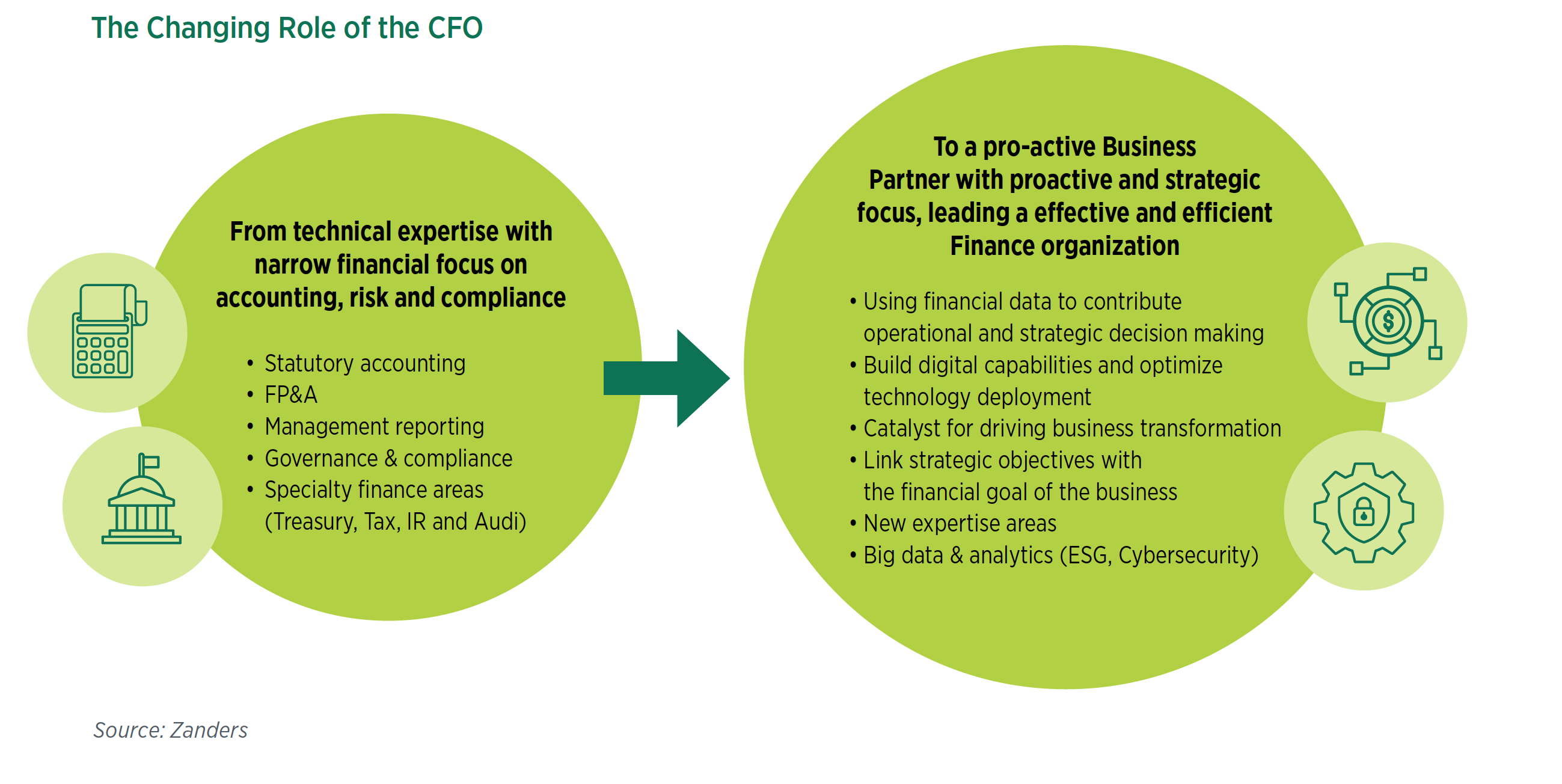

The shifting role of treasury

Treasury is a profession in transition. Initially, it was a niche bill-paying function, almost exclusively found in banks and public finance. Nowadays, it’s a broader finance discipline that takes an integral role in decision-making for larger corporates.

What accelerated the pace of change?

-

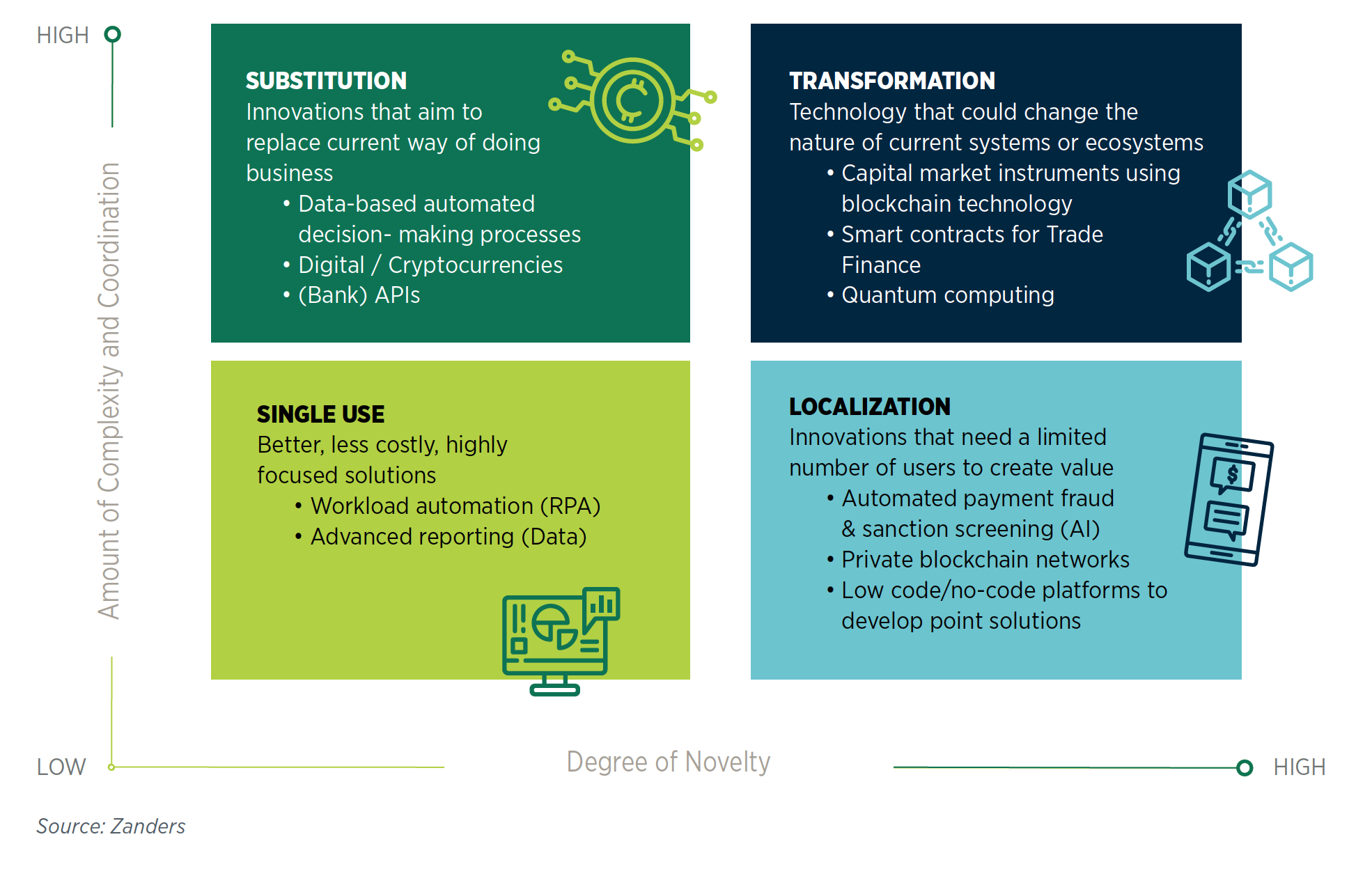

Treasury Innovation

Innovation is an important driver of the dramatic evolution we’ve seen in treasury, particularly in the last decade. how has the use of technology contributed to the changes in the profession, and why is it set to have an influential role in the shape of treasury teams of the future?

Adoption of Foundational Technologies in Treasury

-

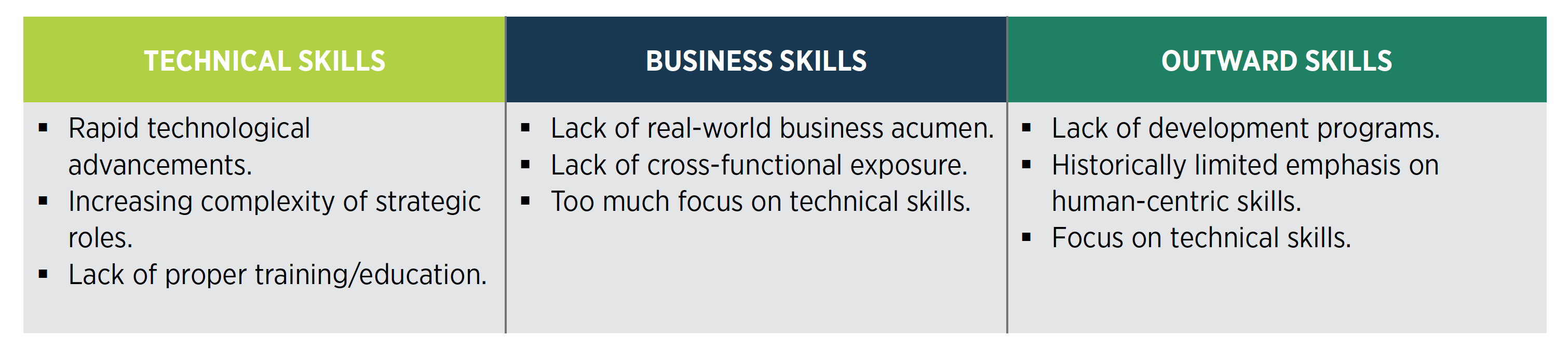

Skills Gap in Treasury

A fast-changing treasury landscape has exposed skills gaps across the profession. To build a function that will not only survive but thrive in a new, digital-first world, companies must rethink what skills they seek from new hires.

What’s Driving the Skills Gap?

-

DE&I and Treasury

As the treasurer’s role as a strategic partner to the business grows, diversity is becoming a bigger priority. Teams that are diverse, equitable and inclusive (DE&I) are better able to win top talent, generate more innovative ideas, respond to challenges and meet the needs of different stakeholders.

Benefits of prioritizing DE&I

- More comprehensive decision-making and risk management

- Increasing capacity for innovation and creativity

- Broader perspective and market insights

- A more attractive employer brand attracts top talent

- Enhancing reputation and strengthening relationships

-

Building a Future Treasury Team

Your treasury needs an operating model that can adapt to fluctuating markets and navigate economic uncertainty. When we talk about being fit for the future, it’s about positioning your treasury to stay relevant, so you can maximize its strategic impact whatever the future holds.

Building a treasury operation that’s fit for the future relies on developing three core capabilities:

- Strategic thinking. The capacity and ability to provide commercial insight and strategic guidance to leadership.

- A digital-first mentality: Treasurers need to redefine existing roles and keep digitalization in mind when creating a workforce of the future.

- Business partnering: To deliver an extended scope of responsibility