Research

2024 AFP Liquidity Survey

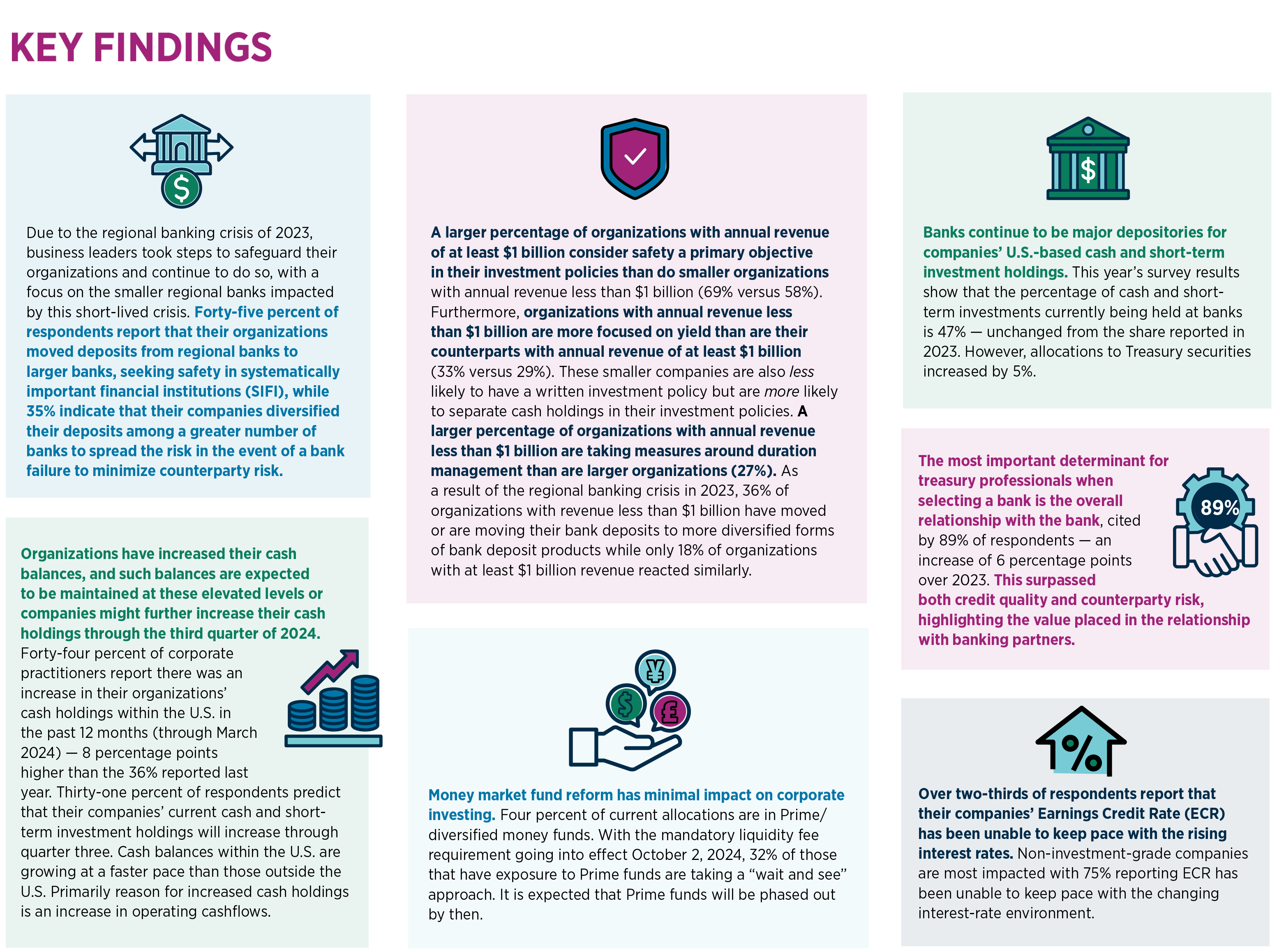

The 2024 AFP® Liquidity Survey, underwritten by Invesco, reports that 45% of organizations moved deposits from regional banks to larger banks in response to the 2023 banking crisis. Additionally, 35% of companies spread their deposits among a greater number of banks to further reduce counterparty risk. This year, 239 treasury and finance professionals participated in this survey and their responses form the basis of this report. The survey, now in its 19th year, was underwritten by Invesco.

Other survey highlights:

- Larger organizations (>$1 billion annual revenue) consider safety a key objective of their investment policy more often (69%) than smaller organizations (58%).

- Banks continue to be major depositories for companies’ U.S.-based cash and short-term investment holdings.

- When selecting a bank, the most important determinant for treasury professionals is the overall relationship with the bank.

- With the mandatory liquidity fee requirement going into effect on October 2, 2024, 32% of those who have exposure to Prime funds are taking a “wait and see” approach.

Not a member? Download the highlights piece.

DOWNLOAD HIGHLIGHTS

Press Inquiries

Press Release - Survey: 45% of Organizations Moved Deposits to Large Banks Proactively Adapting to Challenging Environment

If you are interested in referencing data from this report in marketing materials, etc. please contact Anissa Holm, Research Manager.

Contact pr@afponline.org or call 301.907.2862 for more in-depth information, to read the full report or to arrange an interview with the AFP Research team.

Questions about this subject?

Contact Tom Hunt, AFP's Director of Treasury Services.

Contact Tom Hunt, AFP's Director of Treasury Services.