Financial Operations (FinOps) involves the operational activities performed within a company’s Office of the CFO. The primary purpose of FinOps is to manage the organization’s financial resources.

PART 1

What Do Financial Operations Teams Do?

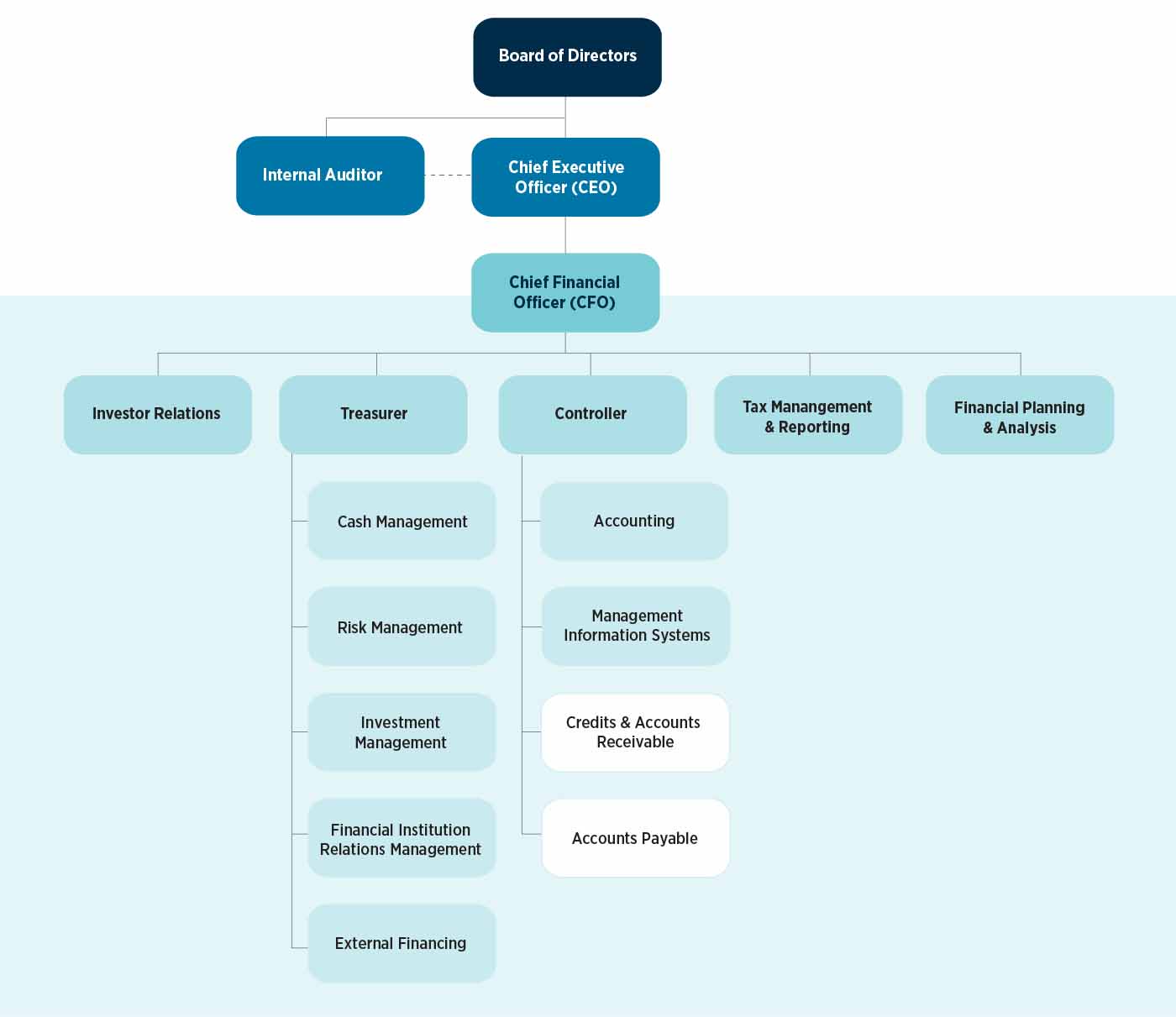

The functions within FinOps typically report to the company’s controller, who is responsible for accounts payable (procure-to-pay) and, at many companies, accounts receivable (order-to-cash), among other functions (Exhibit 1). The accounts payable (A/P) function is responsible for making payments owed by the company to suppliers and other creditors. It verifies incoming invoices, authorizes payments and monitors compliance with trade payment terms. The accounts receivable (A/R) function monitors, tracks and collects money owed by customers for purchases made on credit.

Exhibit 1: Sample functional organization of the finance function

The A/P and A/R teams support a company’s key financial activities, which include:

- Enabling purchasing decisions

- Payment approvals

- Authorizing or receiving value transfers

- Compliance. In these processes, A/P is supporting the buyer, and A/R is supporting the seller.

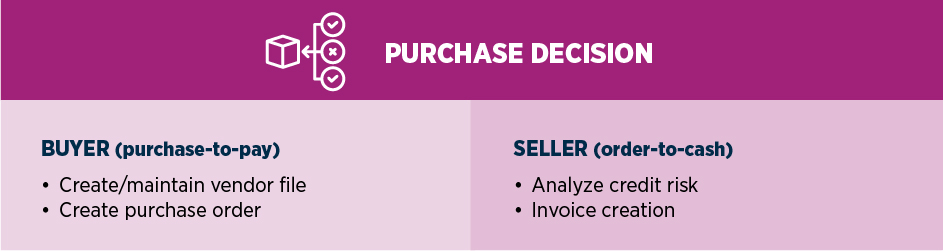

In the purchase decision process, the buyer’s A/P function sets up and maintains a vendor (seller) file and creates a purchase order. On the other side of the transaction, the seller’s A/R team analyzes the buyer’s credit risk.

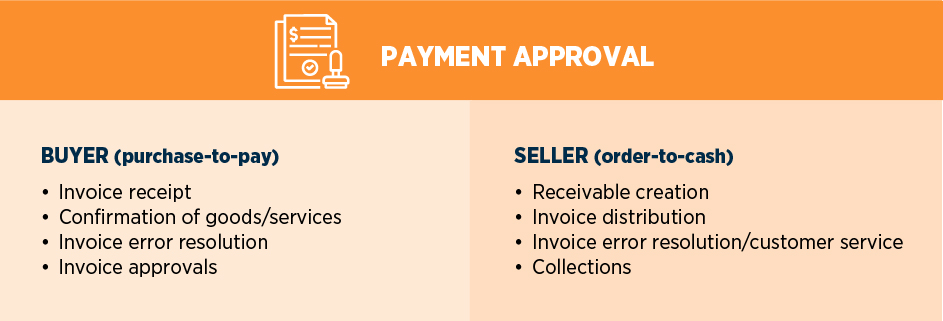

This process is followed by the payment approval process, in which the A/P function receives the invoice, confirms that the goods or services have been satisfactorily provided, resolves any invoice errors, approves the invoice and creates a payable. On the A/R side, the team creates and sends the invoice, creates a receivable, resolves any invoice errors noted by the buyer’s A/P and, when necessary, undertakes any collection efforts with the buyer.

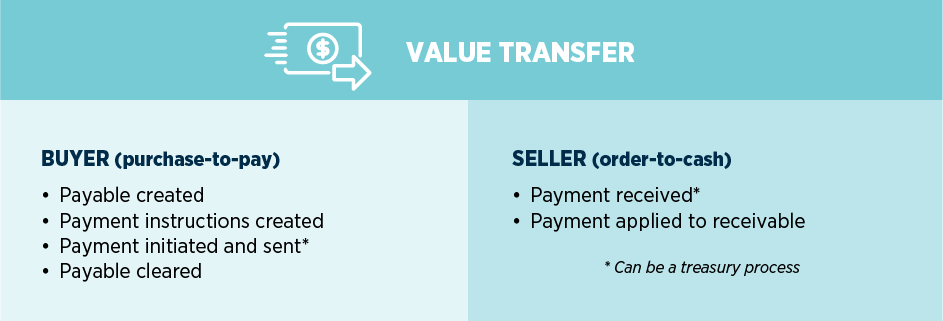

Then the value transfer process is initiated. The A/P group creates payment instructions, and the payment is initiated and sent by the company’s A/P group through the treasury office. A/P then clears the payable. Meanwhile, A/R receives the payment (also often a treasury process), and the payment is applied to the receivable.

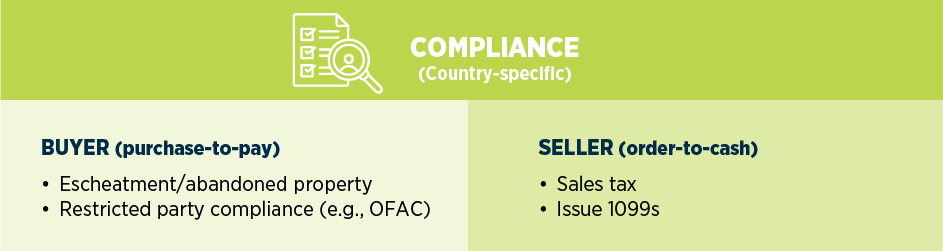

Compliance is country-specific. In the U.S., the A/P function must document and report any escheatment/abandoned property processes, in which unclaimed or abandoned checks or assets are turned over to state authorities. A/P is also responsible for restricted party compliance, in which it screens the seller (A/R) to determine whether it is prohibited by federal law from receiving export-controlled items, information or technology. For example, OFAC maintains a list of sanctioned companies and individuals.

On the A/R side, compliance requires issuing annual 1099 tax forms to individuals and organizations to which the company has paid more than $600 for services. A/R must also pay sales taxes on invoice amounts or cash received (i.e., revenue) for taxable goods or services.

Sign Up for AFP Newsletters

Get expert tips and resources on the topics that matter to financial professionals, delivered to your inbox every month.

PART 2

Best Practices in Financial Operations

To ensure a company’s financial health, FinOps activities and processes must be done well, which means deploying proven best practices whenever and wherever possible. The following best practices in both accounts payable and accounts receivable can help ensure that your FinOps are effective, efficient and beneficial to your company’s cash flow and overall financial health.

Establish clear, consistent policies and procedures for invoicing, credit and collection.

In A/P, policies and procedures should limit access to the master vendor file and set strict internal controls. Allow only designated staff access to the master vendor file to control vendor approvals better and to detect any sham vendors set up to move money out of the business. Make sure that A/P tasks are conducted separately and by more than one employee. Financial fraud becomes far too easy if check-writing, invoice preparation and payment processing are left to a single employee. Cross-train A/P employees in all A/P responsibilities to avoid having a “single point of failure” and to prevent internal fraud.

On the A/R side, policies and procedures should address billing periods and invoicing dates, due dates, grace periods, late fees, information to include on each invoice, recordkeeping, periodic assessments of A/R processes and collections on overdue payments. Following established A/R procedures not only streamlines invoice creation but also decreases errors, prevents or quickly resolves disputes, makes following up on overdue payments more efficient, and prepares you for audits.

Perhaps most important, A/R policies and procedures must include credit and collection processes. Sound credit and collection policies will curb default rates and boost working capital. Specifically, include terms of sale (the amount of credit that can be extended to customers, along with related terms), credit extension criteria and the collection process for past-due invoices. Indicate credit limits, payment terms, accepted methods of payment, the customer data required and your company’s policy for bad debts.

Before extending any credit, thoroughly examine the customer’s credit records to mitigate risk. You can then customize credit amounts and limits to each customer’s risk level and creditworthiness.

Offer and make the most of discounts for early payment.

For the A/P function, the benefits of paying invoices early to get discounts often outweigh any gains from holding onto capital. Taking advantage of discounts that come with paying invoices early saves costs and can even improve a company’s bottom line. Moreover, early payment can make your company a preferred customer and lead to better payment terms.

Offer discounts and incentives for early payment on the A/R side, too — and impose penalties for late payments. When clients pay early, they save money from discounts while your company gains liquidity. In turn, overdue payment penalties not only encourage clients to pay on time but also improve collection rates and compensate for the cost and inconvenience of delayed payments.

Reconcile all accounts daily.

Daily reconciliation creates a structured, controlled environment where you can quickly detect and act on anomalies to thwart fraud, prevent errors in financial statements, resolve disputes promptly and ensure regulatory compliance. Regular reconciliation provides visibility into your company’s current cash position, enabling better, more informed decisions. Additionally, your company will be well-prepared for audits.

Communicate clearly, regularly and consistently with vendors and customers.

Effective communication with customers and vendors leads to smoother transaction processing and quick resolution of discrepancies — while also building trust and strengthening business relationships.

A robust communication channel allows the A/P team to manage payment terms better, negotiate discounts, and ensure a reliable supply of goods and services. On the A/R side, it can prevent disputes, optimize the customer experience and mitigate the risk of delayed payments. Customers have the opportunity to express any concerns, so you can quickly resolve them. Be sure to keep customers informed about their payment status, and tailor communications to clients’ particular needs and preferences while maintaining consistency.

Review your data often.

Regular data review can mitigate security risks and fraud, uncover trends in your processes, assist in cash-flow planning, track the value and volume of invoices and payments, and help build a digital audit trail. For best results, use centralized data storage and advanced analytics and reporting, if available.

Track performance using KPIs.

Using KPIs to measure performance yields data-driven insights and allows you to make better strategic decisions. Measuring progress uncovers opportunities for improvement, successful accomplishments and potential issues. It also enables comparative analysis against industry standards.

KPIs should reflect business objectives and measure how effectively the A/P and A/R functions support those goals. Some potential KPIs for A/P include:

- Cost per invoice

- Days payable outstanding (DPO)

- Payment error rates and/or late payment rates

- Invoice approval/processing time

- Invoice exception rates

- Percentage of discounts captured

- Payment cycle times

- Accounts payable expense as percentage of revenue

A/R KPIs might include:

- Days sales outstanding (DSO)

- Average days delinquent

- Turnover ratio — i.e., how quickly the business is collecting from clients

- Collection effectiveness index (CEI) — i.e., a company's total accounts receivable divided by its total sales

- Rate of invoice revisions/disputes

- Bad debt write-offs

- Cost of credit

Digitize everything.

Manual, paper-based processes are often rife with mistakes like misplaced or duplicate invoices or payments, errors in data entry and even fraudulent activity. Digitization reduces or even prevents these problems altogether and makes the A/P and A/R functions more efficient and less costly.

You can digitize A/P processes through e-invoicing and by creating digital workflows, managing payments online, and using cloud computing for archival and storage. Digitizing the invoice-to-pay workflow not only streamlines these processes but also boosts productivity and offers scalability that is impossible with paper.

A/R can be digitized by using e-billing and online payments, which can be integrated so clients can initiate payment from their bills. For overdue payments, set up automatic follow-up actions.

Automate everything (or as much as possible).

Automating mundane, repetitive A/P and A/R tasks allows employees to focus on strategic activities that enhance their organization’s financial well-being, such as data analysis, managing supplier and customer relationships and optimizing working capital.

The A/P function can be automated from end to end, from invoice receipt to invoice matching, workflow routing, approvals, reconciliation and reporting. Automated A/P systems can pull data from invoices, match them to purchase orders and facilitate timely payments by following pre-set rules. The status of invoices and payments is available in real time to enable accurate financial forecasts and effective cash-flow management. You can maintain an auditable trail of all transactions to mitigate fraud risk.

When the A/R function is automated, invoicing is electronic, and reminders are automatic. You can share access with customers to a cloud-based portal containing invoices, account statuses and payment methods, making communications consistent and the entire A/R function faster, easier and more effective. You’ll optimize cash flow by curtailing late payments and making them more predictable.

Automate the most tedious A/R activities — the repetitive, time-consuming, low-value-added tasks — so that A/R teams can focus on communicating with clients, sending invoices and reminders and strategic, value-added activities.

Other financial operations processes, such as reporting and analysis, can also be automated. You can run consistent, digitized reports for in-depth analysis and to make fast business decisions with real-time data. Those reports can be automatically delivered to designated staff through selected channels at any time of day.

PART 3

Technology in Financial Operations

The future of FinOps will be marked by ever-increasing automation, especially with the advance of AI and machine learning (ML). According to Accenture, 80% of traditional finance tasks — rote, repetitive and manual activities — could be automated, allowing FinOps teams to engage in activities that can grow the business, such as advising, planning and analyzing.

Leveraging ERPs for Embedded Finance

ERP systems are software systems that integrate all of an organization’s essential business processes, such as human resources, manufacturing, supply chain, finance, services, procurement and accounting processes, among others. A few examples are Oracle’s NetSuite, SAP Business One and Microsoft Dynamics 365.

Banks and fintechs are starting to connect to ERPs through APIs to provide “embedded finance,” in which financial services are integrated into ERPs’ non-financial workflows. That way, many financial operations processes can be automated and executed through a single, integrated source that contains all data — including customer and supplier data — gathered from all business and financial processes.

For example, many month-end close activities can be integrated with a centralized ERP system. Through the ERP, all of your financial systems and resources would be synchronized and kept up to date, allowing you to avoid the complexity of dealing with siloed, incomplete or inaccurate data when undertaking month-end close processes.

Embedded finance is on the rise and already generating substantial revenue for the companies deploying it. According to recent research by Bain Capital Ventures, embedded finance accounted for $21 billion in revenue on $2.6 trillion in total transaction volume in 2021 and is expected to exceed $51 billion in revenue on $7 trillion in volume by 2026. Financial operations could soon become completely integrated with other business processes, allowing AI to detect patterns, anomalies and more from a vast trove of data to enable modeling, forecasting and predictive cash-flow management.

The Power of AI and ML

With AI and ML, bookkeeping, expense management, month-end close, reconciliation, tax compliance and more could all be programmed and executed with little human intervention. The A/P function in particular has immense potential for AI- and ML-driven innovation. Extraction of data from invoices, categorization, and even fraud detection can all be automated by AI and ML.

ML algorithms can analyze historical data to predict future trends, optimize payment times and identify opportunities for cost savings, such as potential early payment discounts. AI can improve compliance by continuously learning and adapting to new regulatory requirements, reducing the risk of errors and non-compliance penalties. For smaller businesses, AI systems can manage data and transaction volumes at scale to provide real-time insights.

Examples of specific A/P processes that can be transformed by AI include:

- Invoice receipt. AI-powered optical character recognition (OCR) technology can extract relevant information — such as invoice numbers, amounts and due dates — from invoices, even if their formatting or style changes. If an invoice does not match a purchase order because of a price variation, AI will detect and correct the discrepancy.

- Generating and sending invoices, matching them with the associated purchase orders and tracking related payments.

- Proactive debt collection using customers’ behavior patterns and financial data to predict potential late payments or defaults. Based on these analyses, AI systems can produce customized reminders and suggestions to better the odds of timely payment, making aggressive debt collection unnecessary.

- Generating data-driven insights by extracting and analyzing A/R data, such as payment trends, customer behaviors and collection metrics, to provide businesses with valuable intelligence that could help them optimize A/R processes, find opportunities for improvement and boost financial performance.

AI will also improve fraud detection to keep up with ever-evolving fraud schemes by applying ML algorithms designed to analyze behaviors and detect variances that could point to fraud. It starts from a baseline of typical transaction patterns and user behaviors. Then, as it observes data, it searches for deviations from this baseline. As it comes across new and varied data, AI continuously “learns” and refines its parameters to differentiate between valid and questionable activities more precisely. All of this is done in real time, at scale.

The Transformative Potential of Generative AI

Research by McKinsey & Company shows that generative AI (GenAI) could automate up to 70% of business activities — across almost all occupations — by 2030, adding “trillions of dollars in value” to the global economy. Today, GenAI is still in the nascent stages of facilitating and augmenting FinOps, but in the near future, it is expected to transform core financial processes. It will work with traditional AI tools to generate reports, insights and recommendations and even to explain anomalies, making the finance function a potential source of critical insights.

As Boston Consulting Group notes, GenAI tools are primarily used today to process and generate text and images; they cannot yet produce numerical analyses that are accurate enough for use in finance. They can analyze limited data sets, but outcomes are still unreliable without human intervention. As GenAI gets smarter, however, it will analyze large data sets with sufficient accuracy, and AI-driven “co-pilots” or “assistants” will emerge to support and augment financial operations. Microsoft 365 Copilot, for example, provides real-time suggestions to improve documents, presentations and spreadsheets.

In financial operations, copilots could revolutionize the function by:

- Transforming core processes, such as invoice processing. For invoices, GenAI can extract data from unstructured documents in almost any format and language, intelligently map that data to its relational context and adapt to varying layouts. It can even interpret handwritten content. As it matures, GenAI will integrate seamlessly with processes that are currently manual or tedious.

- Managing and mitigating risk. FinOps teams are already using AI environments to find anomalies that could indicate fraud or noncompliance. GenAI could take this a step further by predicting and explaining those anomalies and their associated risk.

The Bright Future of Financial Operations

These are just some of the ways in which GenAI and other innovative technologies can enable FinOps to flourish, with predictable cash flows, unprecedented efficiency, minimal bad debt and optimized working capital, making FinOps even more essential to your company’s financial health.

As a professional in FinOps, you may fear that your position could be automated out of existence, but these technologies can help you do more faster and make you exponentially more productive. A McKinsey study, for example, found that software engineers completed their coding tasks up to twice as fast when using GenAI. It can also facilitate training and help employees learn new skills faster.

Digitization, automation and these new technologies will take the tedium out of financial operations and make your job more interesting and challenging. You’ll be able to concentrate on value-generating, strategic tasks that will benefit your company — and you.

PART 4

Learn More About Financial Operations

Articles

- Credit Card Processing Explained: What It Is and How It Works

- Interchange Fees Explained: What They Are and How They Work

- The Value of Payments Pre-Validation

- Getting Paid Faster: How AI-Driven Automation Can Expedite and Enhance Accounts Receivable

- Choosing the Right Payment Method: The Pros and Cons of Each

- Making the Switch: Moving from Checks to Digital Payments